UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM |

(Mark One)

For the fiscal year ended:

or

For the transition period from __________ to __________

Commission file number:

|

|

|

(Exact name of registrant as specified in its charter) |

||

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|||

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☑ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the registrant's Class A common stock, $0.01 par value per share, held by non-affiliates of the registrant as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was $

As of March 23, 2023, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2023 Annual Meeting of Stockholders, which will be filed with the U.S. Securities and Exchange Commission within 120 days after December 31, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

|

Page |

3 |

||

PART I |

||

Item 1. |

7 |

|

Item 1A. |

20 |

|

Item 1B. |

39 |

|

Item 2. |

39 |

|

Item 3. |

44 |

|

Item 4. |

44 |

|

Item 5. |

45 |

|

Item 6. |

45 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 |

Item 7A. |

61 |

|

Item 8. |

62 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

110 |

Item 9A. |

110 |

|

Item 9B. |

110 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

111 |

Item 10. |

112 |

|

Item 11. |

112 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

112 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

112 |

Item 14. |

112 |

|

Item 15. |

113 |

|

Item 16. |

117 |

|

118 |

||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include those that express a belief, expectation or intention, as well as those that are not statements of historical fact. Forward-looking statements include information regarding our future plans and goals, as well as our expectations with respect to:

These forward-looking statements may be accompanied by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “will,” “should,” “could,” “would,” “likely,” “future,” “budget,” “pursue,” “target,” “seek,” “objective,” or similar expressions that are predictions of or indicate future events or trends that do not relate to historical matters.

The forward-looking statements in this Annual Report speak only as of the date of this Annual Report, or such other date as specified herein. We disclaim any obligation to update these statements unless required by law, and we caution you not to place undue reliance on them. Forward-looking statements are not assurances of future performance and involve risks and uncertainties. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties include, but are not limited to, the following:

3

These and other important factors that could affect our operating results and performance are described in (i) Part I, Item 1A “Risk Factors” and in Part II, Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report, and elsewhere within this Annual Report, (ii) our other reports and filings we make with the SEC from time to time, and (iii) other announcements we may make from time to time. Should one or more of the risks or uncertainties described in the documents above or in this Annual Report occur, or should underlying assumptions prove incorrect, our actual results, performance, achievements or plans could differ materially from those expressed or implied in any forward-looking statements. All such forward-looking statements in this Annual Report are expressly qualified in their entirety by the cautionary statements in this section.

4

Summary of Principal Risk Factors

Our business is subject to a number of risks and uncertainties. The following is a summary of the principal risk factors that could materially adversely affect our business, financial condition and results of operations. A more complete statement of those risks and uncertainties is set forth in “Risk Factors” in Item 1A of Part I of this Annual Report.

5

6

PART I

ITEM 1. BUSINESS

Unless the context otherwise requires or as is otherwise indicated, references in this Annual Report to the “Company,” “ProFrac,” “we,” “our” and “us,” or like terms, refer to (i) before the completion of the Corporate Reorganization, ProFrac Holdings, LLC, a Texas limited liability company (“ProFrac LLC”), and its consolidated subsidiaries; and (ii) following the completion of the Corporate Reorganization, ProFrac Holding Corp., a Delaware corporation (the “Issuer”), and its consolidated subsidiaries.

When we refer to a “fleet” or a “frac fleet,” we are referring to the pumping units, truck tractors, data trucks, storage tanks, chemical additive and hydration units, blenders and other equipment necessary to perform well stimulation services, including back-up pumping capacity.

Overview and Strategy

We are a technology-focused, vertically integrated energy services company providing well stimulation services, proppants production and other complementary products and services to oil and gas companies engaged in exploration and production (“E&P”) of unconventional oil and natural gas resources throughout the United States. Founded in 2016, ProFrac was built to be the go-to service provider for E&P companies’ most demanding hydraulic fracturing needs. Our business combines a young fleet of modern, technologically advanced pressure pumping equipment with vertically integrated proppant, chemicals and manufacturing, enabling us to deliver premium service quality while maintaining an advantaged cost structure. We believe the technical and operational capabilities of our fleets, as well as our internal frac sand production and equipment manufacturing capabilities uniquely position us to capitalize on the growing demand for well stimulation services to support the ongoing development of American oil and gas reserves. Additionally, we have a focused M&A strategy to acquire high-quality businesses at attractive valuations that increase our scale and expand our technological and supply chain competencies. Since the completion of our IPO, we have completed six acquisitions adding approximately 18.7 million tons of annual sand capacity and 13 frac fleets. These acquisitions provide us with an opportunity to generate attractive returns, when combined with our operational and commercial platform.

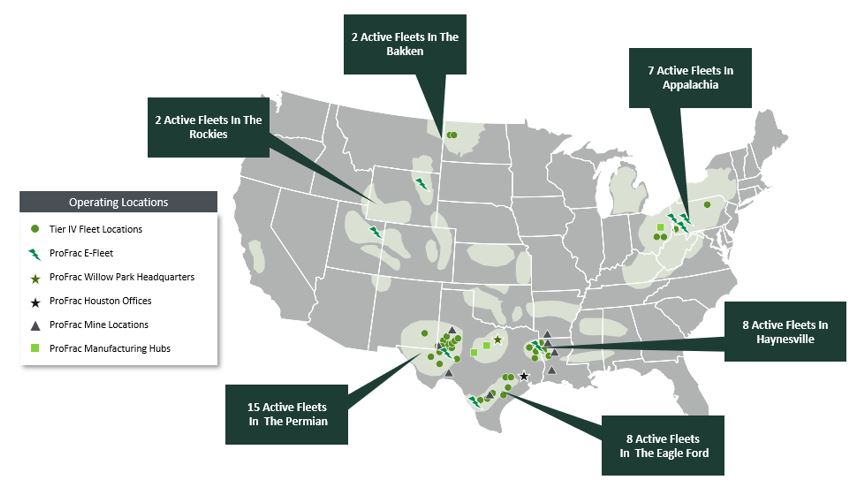

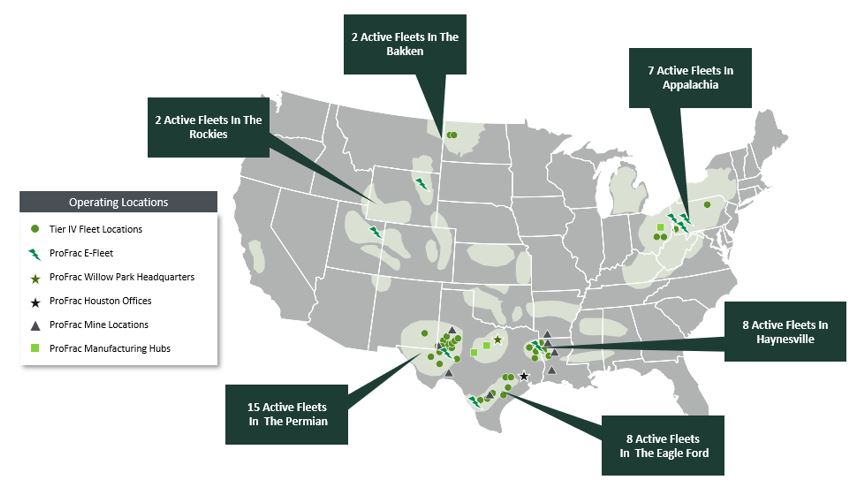

Our operations are focused on the most active unconventional regions in the United States, where we have cultivated deep and longstanding customer relationships with some of those regions’ leading E&P companies. We believe we are among the largest well stimulation services providers in the United States, with 42 active fleets as of January 3, 2023. We operate throughout nearly all major unconventional oil and gas basins in the United States and our scale and geographical footprint provide us with both operating leverage as well as exposure to a diversified customer and commodity mix.

We employ a differentiated business model, focused on vertical integration, technological innovation and actively acquiring assets and businesses that expand our capabilities. In combination with our deep technical expertise, our ability to design and manufacture equipment and internally produce proppant positions us to custom tailor our products and services to meet the needs of our customers. Additionally, we believe we are uniquely positioned as an industry consolidator. ProFrac’s management team has extensive expertise in making strategic acquisitions, as well as a proven ability to rapidly and successfully integrate acquired businesses into our operations.

7

The following map shows our operating locations throughout the United States as of January 3, 2023:

Business Strategies

We are focused on employing new technologies to significantly reduce “greenhouse gas” (“GHG”) emissions and increase efficiency in what has historically been an emissions-intensive component of the unconventional E&P development process. We believe the technical and operational capabilities of our fleets position us to serve our customers’ shifting preferences, which are increasingly favoring the sustainable development of natural resources. We intend to create value for our stakeholders through the following business strategies:

8

Operating Segments

Stimulation Services Segment

ProFrac is one of the largest providers of well stimulation services in the United States. As of January 3, 2023, we had 42 active fleets, with an additional four fleets under construction. Our total fleet includes 20 Tier IV fleets (17 of which are dual fuel or DGB), eight electric fleets and four newbuild electric fleets. Currently, our operations are focused on the Permian Basin, Eagle Ford, Haynesville, Appalachia and the Rockies. With our broad operating footprint, we are able to serve a diversified customer base with balanced exposure to public and private E&P customers that are developing both oil and natural gas reserves.

Our conventional hydraulic fracturing fleets have been designed to handle the most demanding well completions, which are characterized by higher pumping pressures, higher pumping volumes and longer horizontal wellbores. We continue to upgrade and overhaul our fleets with the goal of having all of our conventional fleets similarly equipped with lower-emission Tier IV diesel engines, a process made cheaper by our in-house manufacturing capabilities detailed below. Additionally, we continue to expand our electric frac fleets. This strategy aligns with our environmental focus to minimize our carbon footprint as a part of our goal to have all of our conventional fleets equipped with emissions reduction technology.

9

In addition to our conventional fleets, we are constructing and have acquired electric powered fleets. This technology utilizes electric motors powered by lower-cost, lower-emission power solutions, primarily using on-site generation from natural gas produced and conditioned in the field or compressed natural gas (“CNG”). We believe that this fuel supply can provide our customers with additional tools to meet their emissions and sustainability goals by reducing their reliance on diesel fuel, as well as offer significant fuel cost savings. These fleets are intended to provide our customers a suite of options to satisfy their ESG objectives while maximizing operating efficiency.

Our stimulation services competitors include Halliburton Company, Liberty Energy Inc. and NexTier Oilfield Solutions Inc.

Proppant Segment

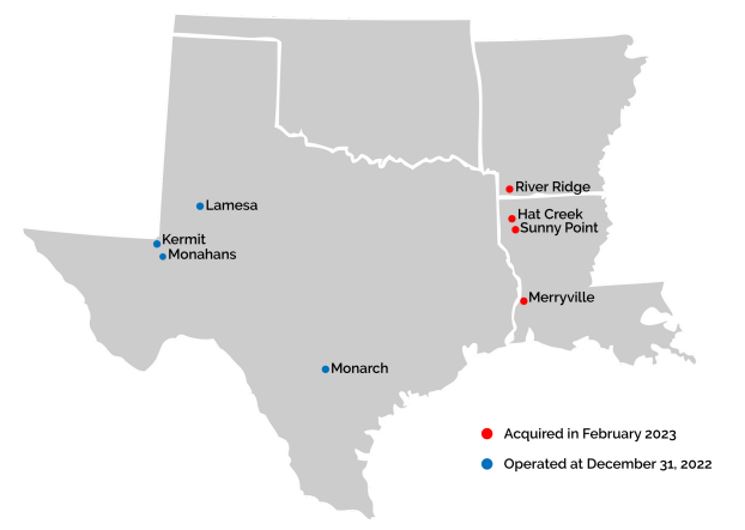

In connection with our vertically integrated business model, we own and operate frac sand mines and processing facilities. We are the largest producer of in-basin proppants, with approximately 21 million tons of annual production capacity across eight mines serving the Permian Basin, Eagle Ford and Haynesville markets. Acquiring and integrating sand mines is a critical element of our operating strategy. Since December 2021, we have completed four proppant acquisitions, consisting of six operating mines and one greenfield development which we brought to production in December 2022.

Our mines are strategically located throughout key pressure pumping markets, allowing us to produce proppants in close proximity to the areas in which our fleets operate. We believe that mining our own sand helps to insulate us from market volatility, as ProFrac is able to ensure adequate supply in tight markets, minimizing disruptions to our operations and associated non-productive time, and to bolster fleet profitability through cycles as we aggregate profit margin from the mine to the wellhead. We believe that our scale in proppant production in combination with our logistics expertise supports our ability to deliver best-in-class service quality and cost for our customers. Further, we believe that our concentration of active fleets in the markets in which we operate sand mines provides significant baseload demand that will help us drive utilization of our mines and offer significant opportunities for cost optimization.

Our mining operations currently serve the following markets:

10

Manufacturing Segment

We operate facilities in which we assemble new fleets, refurbish existing fleets, rebuild engines and transmissions, and manufacture many of the components used by our fleets, including pumps, fluid ends, power ends, flow iron and other consumables. These facilities perform substantially all of the maintenance, repair and servicing of our hydraulic fracturing fleets, as well as provide in-house manufacturing capacity that enables cost-advantaged growth and maintenance. Additionally, our internal manufacturing capabilities enable us to upgrade and modernize acquired fleets in a cost-efficient manner.

Vertical integration enables us to realize a lower capital investment and operating expense by capturing the margin of manufacturing and/or maintenance, and by enabling the ongoing improvement of our equipment and processes as part of a continuous research and development cycle. This combination also facilitates our “Acquire, Retire, Replace”™ approach to growing, maintaining and modernizing our fleets, and we believe that it helps us mitigate supply chain constraints that have disrupted competitors’ and customers’ operations in the past. Our in-house manufacturing capabilities also allow us to rapidly implement new technologies in a cost-effective manner.

Our manufacturing capabilities and control over the manufacturing process have allowed us to design and build hydraulic fracturing fleets to uniform specifications intended for deployment in resource basins requiring high levels of pressure, flow rate and sand intensity. We believe the standardized, modular configuration of our equipment provides us with several competitive advantages, including reduced repair and maintenance costs, reduced downtime, reduced inventory costs, reduced complexity in our operations, training efficiencies and the ability to redeploy equipment among operating basins.

2022 Significant Events

Initial Public Offering and Corporate Reorganization

On May 17, 2022, we consummated the initial public offering (“IPO”) of 16,000,000 shares of the Issuer’s Class A common stock, par value $0.01 per share (the “Class A Common Stock”), at a public offering price of $18.00 per share. On June 6, 2022, the underwriters’ over-allotment option was partially exercised, resulting in a sale of an additional 2,228,153 shares of Class A Common Stock at a price of $18.00 per share. The IPO and exercise of the underwriters’ over-allotment option generated combined net proceeds of $301.7 million, after deducting underwriter discounts and commissions and estimated offering costs. In connection with our IPO and the corporate reorganization (see “Note 1. Organization and Description of Business” in the notes to our consolidated financial statements), the Issuer became a holding company.

After giving effect to the corporate reorganization and the IPO, ownership of the issued and outstanding limited liability company interests of ProFrac LLC (the “Units”) was distributed as follows: (i) approximately 27.8% was owned, directly or indirectly, by the Issuer, and (ii) the balance (approximately 72.2%) was owned, together with all of the Issuer’s Class B common stock, par value $0.01 per share (the “Class B Common Stock”) by legacy members.

Information regarding consideration paid in connection with our acquisitions in 2022, discussed below, should be read in conjunction with the further disclosure contained in Note 4 to our consolidated financial statements (see “Note 4. Business Combinations and Asset Acquisition”):

Acquisition of FTS International, Inc.

On March 4, 2022, ProFrac LLC acquired FTS International Inc. (“FTSI”) for a purchase price of approximately $405.7 million, consisting of cash consideration of $332.8 million and certain equity interests in ProFrac LLC of $72.9 million (the “FTSI Acquisition”). Prior to the FTSI Acquisition, FTSI was one of the largest providers of hydraulic fracturing services in North America, with 1.3 million HHP as of December 31, 2021. FTSI averaged 13 active fleets in the fourth quarter of 2021, with operations in the Permian Basin, Eagle Ford Shale, Midcontinent, Haynesville Shale and Uinta Basin.

Consolidation of Flotek Industries, Inc.

Through a series of transactions in the first half of 2022, we entered into a supply agreement with Flotek Industries, Inc. (“Flotek”) to provide full downhole chemistry solutions for 30 of our hydraulic fracturing fleets for a period of ten years starting on April 1, 2022. In exchange for entry into the supply agreement, we received $60.0 million in principal amount of convertible notes, and we received the right to designate up to four out of seven directors to Flotek’s board of directors.

11

Because of our power to appoint directors to the board of directors of Flotek without a direct equity interest in Flotek, we determined that Flotek is a variable interest entity (“VIE”). We further determined that the Company is the primary beneficiary of the VIE, due to our ability to appoint a majority of directors to Flotek’s board of directors. As a result, subsequent to May 17, 2022, the date that Flotek shareholders approved the supply agreement, we have accounted for this transaction as a business combination using the acquisition method of accounting. Accordingly, Flotek’s financial statements have been included in our consolidated financial statements from May 17, 2022.

We believe our investment in and strategic relationship with Flotek demonstrates our commitment to our vertical integration strategy and provides greater control over our supply chain.

Acquisition of SP Silica of Monahans, LLC and SP Silica Sales, LLC

On July 25, 2022, we acquired 100% of the issued and outstanding membership interests of the West Texas subsidiaries of Signal Peak Silica, for a purchase price of $90.0 million in cash (the “Monahans Acquisition”). In connection with the closing of the Monahans Acquisition, we acquired an in-basin frac sand facility and related mining operations in the Permian Basin (the “Monahans Sand Mine”).

Acquisition of U.S. Well Services, Inc.

On November 1, 2022, we acquired U.S. Well Services, Inc. (“USWS”) for a total purchase consideration of $479.1 million, consisting of cash consideration of $195.9 million, issuance of 12.9 million shares of Class A Common Stock valued at $282.0 million, and issuance of Class A Common Stock warrants valued at $1.1 million (the “USWS Acquisition”).

Prior to the USWS Acquisition, USWS was a technology-driven oilfield service company focused on electric-powered pressure pumping services in the United States. The USWS fleets consist mostly of all-electric, mobile pressure pumping equipment and other auxiliary heavy equipment to perform stimulation services. The USWS Clean Fleet® electric fleets replace the traditional engines, transmissions, and radiators used in conventional diesel fleets with electric motors.

Acquisition of Monarch Silica, LLC

On December 23, 2022, we completed the acquisition of the Eagle Ford sand mining operations of Monarch Silica, LLC, and related real estate property, for total purchase consideration of $175 million, consisting of cash consideration of $87.5 million and a secured note payable to the seller, Monarch Capital Holdings, LLC, for the remaining $87.5 million. A portion of the consideration is subject to certain customary post-closing adjustments.

Acquisition of REV Energy Holdings, LLC

On December 30, 2022, we acquired REV Energy Holdings, LLC (“REV”), a privately owned pressure pumping service provider with operations in the Rocky Mountains and Eagle Ford Shale. REV operates three premium frac fleets totaling 204,500 HHP. This acquisition expanded ProFrac’s presence in the Rocky Mountains and Eagle Ford Shale.

We acquired REV for a total purchase consideration of $140.0 million, consisting of (i) a number of shares of Class B Common Stock and Units, valued at $70.0 million, (ii) a secured note payable to BCKW LLC (REV sellers’ representative), with a principal amount of $39.0 million, (iii) approximately $5.5 million in debt assumption, and (iv) cash consideration of $25.5 million. A portion of the total purchase consideration is subject to certain customary post-closing adjustments. The agreement pursuant to which we acquired REV provides for up to $20.0 million of earn-out payments to the sellers if certain EBITDA-based performance targets are achieved during 2023.

Recent Developments

Potential Redemption by Related Parties

See the discussion in Item 9B of this Annual Report.

Acquisition of Producers Service Holdings LLC

On January 3, 2023, we acquired 100% of the issued and outstanding membership interest of Producers Service Holdings LLC (“Producers”), a Delaware limited liability company, an employee-owned pressure pumping services provider serving Appalachia and the Mid-Continent, for approximately $35.0 million of total transaction value, of which approximately half was payable in shares of Class A Common Stock, with the remainder consisting of cash and debt assumption. A portion of the cash consideration is subject to certain customary post-closing adjustments. Through this transaction, we have added three fleets, of which two are currently active, totaling 200,000 HHP as well as a 50,000 square foot manufacturing facility located near Zanesville, OH, through which we plan to expand our manufacturing footprint to support Northeast operations.

12

Acquisition of Performance Proppants

On February 24, 2023, we acquired 100% of the issued and outstanding membership interests in (i) Performance Proppants, LLC, a Texas limited liability company, (ii) Red River Land Holdings, LLC, a Louisiana limited liability company, (iii) Performance Royalty, LLC, a Louisiana limited liability company, (iv) Performance Proppants International, LLC, a Louisiana limited liability company, and (v) Sunny Point Aggregates, LLC, a Louisiana limited liability company (together, “Performance Proppants”) for an aggregate purchase price of $475.0 million, consisting of (x) $469.0 million in cash and (y) a number of shares of Class A Common Stock equal to $6.0 million. A portion of the cash consideration is subject to certain customary post-closing adjustments. Performance Proppants is a frac sand provider in the Haynesville basin.

ESG focus

We are committed to sustainable operations and recognize the importance of ESG principles. As part of our ESG focus, we have established an internal ESG committee with the goal of producing a corporate sustainability report to document our ESG efforts in greater detail.

Customers

Our customers consist primarily of E&P companies in the continental United States. For the year ended December 31, 2022, no individual customer represented more than 10% of our consolidated revenues. For the year ended December 31, 2021, our top three customers individually represented 15%, 10%, and 7% of our consolidated revenues. For the year ended December 31, 2020, our top three customers individually represented 16%, 11%, and 10% of our consolidated revenues. The loss of any of our largest customers could have a material adverse effect on our results of operations.

Seasonality

Historically, our operations have been subject to seasonal factors, and our historical financial results reflect seasonal variations. For example, we have observed a slowdown or pause by our customers around the holiday season in the fourth quarter, some of which may be related to our customers’ annual capital spending budgets. Additionally, our operating results may decline during periods of inclement weather conditions.

Human Capital Management

Our employees are a critical asset and are key to our innovative culture and overall success. We are focused on building upon our high-performance culture by attracting, engaging, developing, retaining and rewarding top talent. We strive to enhance the economic and social well-being of our employees. We are committed to providing a welcoming, inclusive environment for our workforce, with training and career development opportunities to enable employees to thrive and achieve their career goals.

As of December 31, 2022, we employed 3,664 people, none of whom are represented by labor unions or subject to collective bargaining agreements.

Health and Safety. The health, safety, and well-being of our employees is of utmost importance to us. We are an industry leader with a proven track record in safety with a Total Reportable Incident Rate of 0.59 for the year ended December 31, 2022, including our manufacturing division, as compared to the industry average of 0.70, according to the International Association of Oil & Gas Producers.

Employee Welfare and Development. We provide employees the option to participate in health and welfare plans, including medical, dental, life, accidental death and dismemberment and short-term and long-term disability insurance plans. We also offer a number of health and wellness programs, including telemedicine, health screens and fitness reimbursement as well as access to the Employee Assistance Program, which provides employees and their family members access to professional providers to help navigate challenging life events 24 hours a day, 365 days a year.

In response to COVID-19, we adopted enhanced safety measures and practices to protect employee health and safety and continue to follow guidelines from the Centers for Disease Control to protect our employees and minimize the risk of business disruption.

Intellectual Property

USWS has been granted 96 patents worldwide, 60 of which are U.S. patents. These begin to expire in late 2032. USWS has an additional 247 patent applications pending worldwide, 51 of which are U.S. patent applications. Many of these patents were filed in an effort to protect USWS electric fleet technology from being duplicated by competitors. We also use proprietary technology to support our preventative maintenance program and prolong equipment useful life. Although in the aggregate, our trademarks and patents are important to us, we do not regard any single trademark, patent, or group of related trademarks or patents as critical or essential to our business as a whole.

13

Operating Risks and Insurance

Our operations are subject to hazards inherent in the energy services industry, such as accidents, blowouts, explosions, fires and spills and releases that can cause personal injury or loss of life, damage or destruction of property, equipment, natural resources and the environment and suspension of operations.

In addition, claims for loss of oil and natural gas production and damage to formations can occur in the oilfield services industry. If a serious accident were to occur at a location where our equipment and services are being used, it could result in our being named as a defendant in lawsuits asserting large claims.

Because our business involves the transportation of heavy equipment and materials, we may also experience traffic accidents which may result in spills, property damage and personal injury.

Despite what we view as our strong safety record and our efforts to maintain safety standards, we from time to time have suffered accidents in the past and anticipate that we could experience accidents in the future. In addition to the property damage, personal injury and other losses from these accidents, the frequency and severity of these incidents affect our operating costs and insurability and our relationships with customers, employees, regulatory agencies and other parties. Any significant increase in the frequency or severity of these incidents, or the general level of compensation awards, could adversely affect the cost of, or our ability to obtain, workers’ compensation and other forms of insurance, and could have other material adverse effects on our financial condition and results of operations.

We maintain commercial general liability, workers’ compensation, business auto, commercial property, excess liability, and directors and officers insurance policies providing coverage of risks and amounts that we believe to be customary in our industry. Further, we have pollution legal liability coverage for our business entities, which would cover, among other things, third party liability and costs of clean-up relating to environmental contamination on our premises, while our equipment is in transit and while on our customers’ job site. With respect to our hydraulic fracturing operations, coverage would be available under our pollution legal liability policy for any surface environmental clean-up and liability to third parties arising from any surface contamination. We also have certain specific coverage for some of our business segments, including for our hydraulic fracturing services.

Although we maintain insurance coverage of types and amounts that we believe to be customary in the industry, we are not fully insured against all risks, either because insurance is not available or because of the high premium costs relative to perceived risk. Further, insurance rates have in the past been subject to wide fluctuation and changes in coverage could result in less coverage, increases in cost or higher deductibles and retention. Liabilities for which we are not insured, or which exceed the policy limits of our applicable insurance, could have a material adverse effect on our business and financial condition.

Environmental and Occupational Health and Safety Regulations

Our operations are subject to stringent laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection, compliance, and occupational health and safety. Numerous federal, state, and local governmental agencies issue regulations that often require difficult and costly compliance measures that could carry substantial administrative, civil, and criminal penalties and may result in injunctive obligations for non-compliance. States have the option of adopting more stringent environmental standards and regulations than are implemented on the federal level. These laws and regulations may, for example, restrict the types, quantities and concentrations of various substances that can be stored, transported, disposed of or released into the environment; limit or prohibit construction or drilling activities on certain lands lying within wilderness, wetlands, ecologically or seismically sensitive areas and other protected areas; or require action to prevent, control, or remediate pollution from current or former operations. Also, these laws and regulations often require permits, authorizations, or licenses that impose operational restrictions and reporting obligations. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment. Changes in environmental, health and safety laws and regulations occur frequently, and any changes that result in more stringent and costly requirements could materially adversely affect our operations and financial position. For example, following political and administrative changes, it is possible that there may be greater environmental, health and safety restrictions, particularly with regards to hydraulic fracturing, permitting, and greenhouse gas (“GHG”) emissions that may affect our operations. We have not experienced any material adverse effect from compliance with current requirements; however, we cannot guarantee this will always be the case.

Below is an overview of some of the more significant environmental, health and safety requirements with which we must comply. Our customers’ operations are subject to similar laws and regulations. Any material adverse effect of these laws and regulations on our customers’ operations and financial position may also have an indirect material adverse effect on our operations and financial position.

14

Waste Handling. We handle, transport, store and dispose of wastes that are subject to the Resource Conservation and Recovery Act (“RCRA”) and comparable state laws and regulations, which affect our activities by imposing requirements regarding the generation, transportation, treatment, storage, disposal and cleanup of hazardous and non-hazardous wastes. With federal approval, the individual states administer some or all of the provisions of the RCRA, sometimes in conjunction with their own, more stringent requirements. Although certain petroleum production wastes are exempt from regulation as hazardous wastes under the RCRA, such wastes may constitute “solid wastes” that are subject to the less stringent requirements of non-hazardous waste provisions.

Administrative, civil and criminal penalties can be imposed for failure to comply with waste handling requirements. Moreover, the EPA or state or local governments may adopt more stringent requirements for the handling of non-hazardous wastes or re-categorize some non-hazardous wastes as “special waste” or hazardous wastes in the future. Indeed, legislation has been proposed from time to time in the U.S. Congress to re-categorize certain oil and natural gas exploration, development and production wastes as hazardous wastes. Several environmental organizations have also at times petitioned the EPA to modify existing regulations to re-categorize certain oil and natural gas exploration, development and production wastes as hazardous. Any such changes in these laws and regulations could have a material adverse effect on our capital expenditures and operating expenses. Although we do not believe the current costs of managing our wastes, as presently classified, to be significant, any legislative or regulatory reclassification of oil and natural gas exploration and production (“E&P”) wastes could increase our costs to manage and dispose of such wastes.

Remediation of Hazardous Substances. The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA” or “Superfund”) and analogous state laws generally impose liability without regard to fault or legality of the original conduct, on classes of persons who are considered to be responsible for the release of a hazardous substance into the environment. These persons can include the current owner (or lessee) or operator of a contaminated facility, a former owner (or lessee) or operator of the facility at the time of contamination, and those persons that disposed or arranged for the disposal of the hazardous substance at the facility. Liability for the costs of removing or remediating previously disposed wastes or contamination, damages to natural resources, and the costs of conducting certain health studies, among other things, is strict and joint and several. In the course of our operations, we use materials that, if released, could be subject to regulation under CERCLA and comparable state laws. Therefore, governmental agencies or third parties may seek to hold us responsible under CERCLA and comparable state statutes for all or part of the costs to clean up sites at which such hazardous substances have been released. Such liability could require us to engage in expensive litigation to defend the claims, and to allocate our proportionate share of liability, if any. Further, we may need to make significant expenditures to investigate and remediate such contamination or attain and maintain compliance with such laws, which could have a material adverse effect on our results of operations, competitive position or financial condition.

NORM. In the course of our operations, some of our equipment may be exposed to naturally occurring radioactive materials (“NORM”) associated with oil and gas deposits and, accordingly, may result in the generation of wastes and other materials containing NORM. NORM exhibiting levels of radiation in excess of established state standards are subject to special handling and disposal requirements, and any storage vessels, piping and work area affected by NORM may be subject to remediation or restoration requirements.

Some of our operations involve equipment containing regulated radioactive materials that require federal and/or state permits, reporting, testing and proper management practices. Any releases from that equipment may result in liability and/or an obligation to complete remediation and restoration.

Water Discharges. The Clean Water Act (“CWA”), Safe Drinking Water Act (“SDWA”), Oil Pollution Act (“OPA”) and analogous state laws and regulations impose restrictions and strict controls regarding the unauthorized discharge of pollutants, including produced waters and other oil and gas wastes, into regulated waters. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or the state. Federal and state laws and regulations may also regulate the discharge of stormwater or discharge to groundwater, often necessitating additional permits and design criteria. The discharge of dredge and fill material into regulated waters, including wetlands, is also prohibited, unless authorized by a permit issued by the U.S. Army Corps of Engineers (the “Corps”). The scope of these regulated waters has been subject to controversy in recent years, culminating in the issuance of a revised definition of “waters of the United States” by EPA in December 2022, which exerts federal jurisdiction under the CWA over traditional navigable waters, the territorial seas, interstate waters, as well as upstream water resources that significantly affect those waters. Additionally, many states have similar requirements that apply to state waters where federal jurisdiction ends, and as a result, under most circumstances, discharges of pollutants reaching any permanent waterbodies will likely be regulated.

15

Noncompliance with the CWA, SDWA, OPA, or other laws or regulations relating to water discharges may result in substantial administrative, civil and criminal penalties, as well as injunctive obligations, for us or our customers. The process for obtaining or renewing permits also has the potential to delay operations. Additionally, spill prevention, control and countermeasure plan requirements require appropriate containment berms and similar structures to help prevent the contamination of regulated waters.

Air Emissions. The Clean Air Act (“CAA”) and comparable state laws and regulations, regulate emissions of various air pollutants through the issuance of permits and the imposition of other emissions control requirements. The EPA has developed, and continues to develop, stringent regulations governing emissions of air pollutants from specified sources. New facilities may be required to obtain permits and meet more stringent design criteria before work can begin, and existing facilities may be required to obtain additional permits and incur capital costs in order to remain in compliance. For example, the EPA has established emission control requirements for crude oil and natural gas production and processing operations and established criteria for aggregating multiple small surface sites into a single source for air quality permitting purposes, which could cause small facilities, on an aggregate basis, to be deemed a major source subject to more stringent air permitting processes and requirements. These and other laws and regulations may increase the costs of compliance for some facilities where we operate. Obtaining or renewing permits also has the potential to delay the development of oil and natural gas projects.

Climate Change. Climate change continues to attract considerable public and scientific attention. As a result, numerous proposals have been made and are likely to continue to be made at the international, national, regional and state levels of government to monitor and limit emissions of carbon dioxide, methane and other GHGs. These efforts have included consideration of cap-and-trade programs, carbon taxes, GHG reporting and tracking programs and regulations that directly limit GHG emissions from certain sources.

In the United States, no comprehensive climate change legislation has been implemented at the federal level. However, President Biden has highlighted addressing climate change as a priority of his administration and has issued several executive orders addressing climate change. Moreover, following the U.S. Supreme Court finding that GHG emissions constitute a pollutant under the CAA, the EPA has adopted regulations that, among other things, establish construction and operating permit reviews for GHG emissions from certain large stationary sources, require the monitoring and annual reporting of GHG emissions from certain petroleum and natural gas system sources in the United States, and together with the DOT, set GHG emissions and fuel economy standards for vehicles in the United States. The regulation of methane from oil and gas facilities has been subject to uncertainty in recent years. The EPA previously had promulgated the New Source Performance Standards (“NSPS”), imposing limitations on methane emissions from sources in the oil and gas sector. Subsequently, in September 2020, the Trump Administration rescinded those methane standards and removed the transmission and storage segments from the oil and gas source category under the CAA’s NSPS. However, in June 2021, President Biden signed a resolution passed by the U.S. Congress under the Congressional Review Act nullifying the September 2020 rule, effectively reinstating the prior standards. In November 2021, as required by President Biden’s executive order, the EPA proposed new regulations to expand NSPS requirements for oil and gas sector sources and establish comprehensive standards of performance and emission guidelines for methane and volatile organic compound emissions from existing operations in the oil and gas sector, including the exploration and production, transmission, processing, and storage segments. The EPA published its proposed rule in November 2022 to update, strengthen and expand its November 2021 proposal by reducing emissions of methane and other air pollutants from both new and existing oil and gas operations. The EPA held a public hearing in January 2023 and the comment period closed in February 2023. Once finalized, the regulations are likely to be subject to legal challenge and will also need to be incorporated into the individual state’s implementation plans, which will need to be approved by the EPA in individual rulemakings that could also be subject to legal challenge. The reinstatement of direct regulation of methane emission for new sources and the promulgation of requirements for existing oil and gas customers could result in increased costs for our customers and consequently adversely affect demand for our services.

16

Separately, various states and groups of states have adopted or are considering adopting legislation, regulation or other regulatory initiatives that are focused on such areas as GHG cap and trade programs, carbon taxes, reporting and tracking programs, and restriction of GHG emissions. For example, several states, including Pennsylvania and New Mexico, have proposed or adopted regulations restricting the emission of methane from E&P activities. At the international level, the United Nations-sponsored “Paris Agreement” requires member states to submit non-binding, individually-determined reduction goals known as Nationally Determined Contributions every five years after 2020. President Biden has recommitted the United States to the Paris Agreement and, in April 2021, announced a goal of reducing the United States’ emissions by 50-52% below 2005 levels by 2030. In November 2021, President Biden released “The Long-Term Strategy of the United States: Pathways to Net-Zero Greenhouse Gas Emissions by 2050,” which, among other things, explains that the U.S. and EU are co-leading the “Global Methane Pledge” that aims to cut global methane pollution at least 30% by 2030 relative to 2020 levels. Further, in 2022, the Biden Administration signed the Inflation Reduction Act (“IRA”) that committed to spending approximately $375 billion over a decade, primarily on promoting “clean energy,” in the form of incentives for solar and wind power and electric vehicles. However, the bill calls for new oil and gas leasing on federal lands and in federal waters. In addition, for the first time ever, the IRA imposes a fee on methane emissions from certain facilities, including certain oil and gas facilities but provides for a conditional exemption from the fee if facilities are subject to and are in compliance with EPA methane regulations that are (1) in effect nationwide, and (2) will “result in equivalent or greater emissions reductions as would be achieved” if EPA’s November 2021 proposed rule (“New Source Performance Standards and Emissions Guidelines for Existing Sources from the Oil and Gas Sector”) were finalized as proposed. The full impacts of these orders, pledges, agreements, and any further legislation or regulation promulgated to fulfill the United States’ commitments under these initiatives cannot be predicted at this time.

Governmental, scientific, and public concern over the threat of climate change arising from GHG emissions has resulted in increasing political risks in the United States, including climate change related pledges made by certain candidates now in public office. On January 27, 2021, President Biden issued an executive order that calls for substantial action on climate change, including, among other things, the increased use of zero-emission vehicles by the federal government, the elimination of subsidies provided to the fossil fuel industry, and increased emphasis on climate-related risks across government agencies and economic sectors. The Biden Administration has previously also issued orders suspending the issuance of new leases pending a study, of oil and gas development on federal lands. In addition, in November 2022, the BLM issued a proposed rule to reduce the waste of natural gas from venting, flaring and leaks during oil and gas production activities on federal and American Indian leases. For more information, see our regulatory disclosure below titled “Regulation of Hydraulic Fracturing and Related Activities.” As a result, we cannot predict the full impact of these developments or whether the Biden Administration may pursue further restrictions. Other actions that could be pursued by the Biden Administration may include the imposition of more restrictive requirements for the establishment of pipeline infrastructure or the permitting of LNG export facilities, as well as more restrictive GHG emission limitations for oil and gas facilities.

Additionally, in March 2022, the SEC proposed new rules relating to the disclosure of a range of climate-related risks. At this time, we cannot predict the costs of implementation or any potential adverse impacts resulting from the rule. To the extent this rule is finalized as proposed, we or our customers could incur increased costs related to the assessment and disclosure of climate-related risks. In addition, enhanced climate disclosure requirements could accelerate the trend of certain stakeholders and lenders restricting or seeking more stringent conditions with respect to their investments in certain carbon intensive sectors.

The adoption and implementation of new or more stringent international, federal or state legislation, regulations or other regulatory initiatives that impose more stringent standards for GHG emissions from the oil and natural gas sector or otherwise restrict the areas in which this sector may produce oil and natural gas or generate the GHG emissions could result in increased costs of compliance or costs of consuming, and thereby reduce demand for oil and natural gas, which could reduce demand for our services. Additionally, political, litigation and financial risks may result in our customers restricting or canceling production activities, incurring liability for infrastructure damages as a result of climatic changes, or impairing their ability to continue to operate in an economic manner, which also could reduce the demand for our services. One or more of these developments could have a material adverse effect on our business, financial condition and results of operation.

17

Endangered and Threatened Species. Environmental laws such as the Endangered Species Act (“ESA”) and analogous state laws may impact exploration, development and production activities in areas where we operate. The ESA provides broad protection for species of fish, wildlife and plants that are listed as threatened or endangered. Similar protections are offered to migratory birds under the Migratory Bird Treaty Act (“MBTA”) and various state analogs. The U.S. Fish & Wildlife Service (“FWS”) may identify previously unidentified endangered or threatened species or may designate critical habitat and suitable habitat areas that it believes are necessary for survival of a threatened or endangered species. For example, the dunes sagebrush lizard, which is found only in the active and semi-stable shinnery oak dunes of southeastern New Mexico and adjacent portions of Texas (including areas where our customers operate), was a candidate species for listing under the ESA by the FWS for many years. As a result of a recent settlement with the environmental groups, the FWS, in July 2020, acted on a petition to list the dunes sagebrush lizard finding sufficient information to warrant a formal one-year review to consider listing the species. While the listing review is ongoing, FWS has also developed a conservation agreement that would implement certain protective practices for the species and authorize incidental taking of the species resulting from certain covered activities, including exploration and development of oil and gas fields. The conservation agreement is known as a CCAA. We have joined the CCAA in an effort to mitigate potential impacts on our business of a listing of the dunes sagebrush lizard by the FWS. On February 8, 2022, the FWS issued a notice in the Federal Register requesting comments on a draft amendment to the CCAA. Comments were due on March 11, 2022. At this time the draft amendment is still pending.

On November 25, 2022, the FWS announced that the Northern distinct population segments (“DPS”) of the lesser prairie-chicken meets the definition of a threatened species and that the Southern DPS of the lesser prairie-chicken meets the definition of an endangered species. Therefore, FWS listed them as such and finalized a rule under the ESA, which became effective January 24, 2023. Separately, on July 1, 2021, a lawsuit was filed by conservation groups to overturn a 2019 FWS decision listing the eastern hell bender salamander under the ESA. In October 2021, the Biden administration published two rules that reversed changes made by the Trump administration, namely to the definition of “habitat” and a policy that made it easier to exclude territory from critical habitat. On March 23, 2022, the FWS proposed a rule to redesignate the northern long-eared bat from a threatened species to an endangered species under ESA, and to remove its species-specific rule that excluded most development activities from the ESA’s prohibition on taking listed species. The effective date of the redesignation is March 31, 2023. To the extent any protections are implemented or increased for these or any other species or habitat, it could cause us or our customers to incur additional costs or become subject to operating restrictions or operating bans in the affected areas.

Regulation of Hydraulic Fracturing and Related Activities. Our hydraulic fracturing operations are a significant component of our business. Hydraulic fracturing is an important and common practice that is used to stimulate production of hydrocarbons, particularly natural gas, from tight formations, including shales. The process, which involves the injection of water, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production, is typically regulated by state oil and natural gas commissions. Currently, hydraulic fracturing is generally exempt from federal regulation under the Safe Drinking Water Act Underground Injection Control (the “SDWA UIC”) program and is typically regulated by state oil and gas commissions or similar agencies. However, certain federal agencies have increased scrutiny and regulation. For example, in late 2016, the EPA released a final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources under certain limited circumstances. To date, the EPA has taken no further action in response to the 2016 report. Additionally, the EPA has asserted regulatory authority pursuant to the SDWA UIC program over hydraulic fracturing activities involving the use of diesel fuel in the fracturing fluid and issued guidance for such activities. The EPA also previously issued a series of rules under the CAA that establish new emission control requirements for certain oil and natural gas production and natural gas processing operations and associated equipment. The U.S. Bureau of Land Management (the “BLM”) also finalized rules to impose new or more stringent standards for performing hydraulic fracturing on federal and American Indian lands. While this regulation was subsequently rescinded in December 2017, which rescission was upheld by the District Court of Northern California, litigation is ongoing. Additionally, the Biden Administration may seek to revisit these regulations. Separately, the Biden Administration may also pursue further restriction of hydraulic fracturing and other oil and gas development on federal lands. For example, on January 27, 2021, President Biden issued an executive order that, among other things, called for the elimination of fossil fuel subsidies from federal budget requests beginning in 2022 and suspended the issuance of new leases for oil and gas development on federal lands to the extent permitted by law and called for a review of existing leasing and permitting practices for such activities on federal lands (the order clarifies that it does not restrict such operations on tribal lands that the federal government merely holds in trust). In addition, in November 2022, the BLM issued a proposed rule to reduce the waste of natural gas from venting, flaring and leaks during oil and gas production activities on federal and American Indian leases.

18

In response to President Biden’s executive order, the Department of Interior issued a report recommending various changes to the federal leasing program, though many such changes would require Congressional action. However, legal challenges to this suspension are ongoing, and the District Court for the Western District of Louisiana has issued a preliminary injunction against the implementation of this suspension while such challenges are pending. The Biden Administration has appealed the injunction, but is complying with the injunction during the appeals process. Separately, the state of Louisiana, among other states, have challenged the Biden Administration’s use of the social cost of carbon in its decision-making, including federal leasing decisions, resulting in an injunction from the Western District of Louisiana preventing the Biden Administration’s use of the social cost of carbon. In response, the Biden Administration again halted leasing activities. However, the Fifth Circuit Court of Appeals has overturned the lower court’s decision, and the plaintiff states sought review by the Supreme Court, which declined to vacate the Fifth Circuit’s order. On April 15, 2022, the Department of the Interior announced that it would again resume leasing on federal lands, though with significant changes to the program, including an 80% reduction in the number of acres nominated and the first-ever increase in onshore royalties, to 18.7% from 12.5%. Separately, there has been a significant reduction in the number of approvals of applications for permits to drill on federal lands in 2022. However, in 2022, the IRA conditioned issuance of wind and solar rights-of-way on new oil and gas lease sales on federal land. There remains a significant uncertainty and increased regulatory risks and costs relating to onshore oil and gas exploration and production activities. These issues could result in decreased activity on federal land, adversely impacting demand for our services.

As a result, we cannot predict the final scope of regulations or restrictions that may apply to oil and gas operations on federal lands, nor the outcome of pending litigation. Although the executive order does not apply to existing operations under valid leases, ProFrac cannot guarantee that further action will not be taken to curtail oil and gas development on federal lands. Any restrictions for new or existing production activities on federal land could adversely impact our customer’s operations and consequently reduce demand for our services. The increase in royalties associated with leasing on federal lands, and any future increases that may occur, may adversely impact exploration and production activities on federal lands and reduce demand for our services. Further, legislation to amend the SDWA to repeal the exemption for hydraulic fracturing (except when diesel fuels are used) from the definition of “underground injection” and require federal permitting and regulatory control of hydraulic fracturing, as well as legislative proposals to require disclosure of the chemical constituents of the fluids used in the fracturing process, have previously been proposed in Congress. Several states and local jurisdictions in which we or our customers operate also have adopted or are considering adopting regulations that could restrict or prohibit hydraulic fracturing in certain circumstances, impose more stringent operating standards and/or require the disclosure of the composition of hydraulic fracturing fluids.

Federal and state governments have also investigated whether the disposal of produced water into underground injection wells has caused increased seismic activity in certain areas. In response to concerns regarding induced seismicity, regulators in some states have imposed, or are considering imposing, additional requirements in the permitting of produced water disposal wells or otherwise to assess any relationship between seismicity and the use of such wells. For example, Oklahoma has issued rules for wastewater disposal wells that impose permitting and operating restrictions and reporting requirements on disposal wells in proximity to faults and also, from time to time, has implemented plans directing certain wells where seismic incidents have occurred to restrict or suspend disposal well operations. In particular, the Oklahoma Corporation Commission’s well completion seismicity guidelines for operators in the South Central Oklahoma Oil Province (“SCOOP”) and the Sooner Trend (oil field), Anadarko (basin) and Canadian and Kingfisher (countries) (“STACK”) require hydraulic fracturing operations to be suspended following earthquakes of certain magnitudes in the vicinity. In addition, the Oklahoma Corporation Commission’s Oil and Gas Conservation Division has previously issued an order limiting future increases in the volume of oil and natural gas wastewater injected into the ground in an effort to reduce the number of earthquakes in the state. The Texas Railroad Commission has adopted similar rules.

If new laws or regulations that significantly restrict hydraulic fracturing and related activities are adopted, such laws could make it more difficult or costly to perform fracturing to stimulate production from tight formations. In addition, if hydraulic fracturing is further regulated at the federal or state level, fracturing activities could become subject to additional permitting and financial assurance requirements, more stringent construction specifications, increased monitoring, reporting and record keeping obligations, plugging and abandonment requirements and also to attendant permitting delays and potential increases in costs. Such legislative changes could cause us to incur substantial compliance costs, and compliance or the consequences of any failure to comply could have a material adverse effect on our financial condition and results of operations.

19

OSHA Matters. The Occupational Safety and Health Act (“OSHA”) and comparable state statutes regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and the public. In March 2016, the U.S. Occupational Safety and Health Administration issued a final rule to impose stricter standards for worker exposure to silica; our sand mining operations are subject to this rule and, moreover, the rule went into effect on June 23, 2021 for hydraulic fracturing activities. As a result, we or our customers may be required to incur additional costs associated with compliance with these standards, which costs may be material.

Mining Activities. Our sand mining operations are subject to the oversight of the U.S. Mine Safety and Health Administration (“MSHA”), which is the primary regulatory agency with jurisdiction over the commercial silica industry. MSHA regulates quarries, surface mines, underground mines, and the industrial mineral processing facilities associated with quarries and mines. In June 2022, the MSHA launched a new enforcement initiative to better protect miners in the United States from health hazards resulting from repeated overexposure to respirable crystalline silica. MSHA administers and enforces the provisions of the Federal Mine Safety and Health Act of 1977 (“FMSHA”), as amended by the Mine Improvement and New Emergency Response Act of 2006. FMSHA imposes stringent health and safety standards on numerous aspects of our operations inclusive of mineral extraction and processing operations, transportation and transloading of silica and delivery of silica sand to well sites. These standards include, among others, the training of personnel, operating procedures, operating and safety equipment, and other matters. As part of MSHA’s oversight, its representatives must perform at least two unannounced inspections annually for each surface mining facility in its jurisdiction.

Availability of Information

Our website is located at http://www.pfholdingscorp.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports and filings with the SEC are available free of charge on our website as soon as reasonably practicable after the reports are filed with or furnished to the SEC. Information contained on our website is not incorporated into this Annual Report or on our other filings with the SEC. Our filings are also available in hard copy, free of charge, by contacting us at 333 Shops Boulevard, Suite 301, Willow Park, Texas 76087, Attention: Investor Relations, telephone: (254) 776-3722. The SEC also maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Additionally, we make available free of charge on our website:

Item 1A. Risk Factors.

We face various risks and uncertainties in the industry in which we operate and in the course of our business. Investors in our securities should carefully consider the following risk factors and all of the other information set forth or incorporated into this Annual Report. Additional risks and uncertainties not currently known to us, or that we currently deem immaterial, may also adversely affect our business, financial condition, results of operations, or cash flows.

Risks Related to our Growth Strategy

To achieve our growth and vertical integration objectives, our management relies on a rapid succession of strategic acquisitions, investments and procurement arrangements the pace and scope of which may have the potential to adversely affect the day-to-day operation of our business, and our cash flows, financial condition and results of operations.

Since the beginning of 2022, before the May 17th closing of our initial public offering and the start of trading of our Class A Common Stock on the Nasdaq Global Select Market (“Nasdaq”), we have aggressively pursued our growth and vertical integration strategies through a series of acquisitions, investments and procurement arrangements that increased our total assets from $664.6 million at December 31, 2021, to $2.9 billion at the end of fiscal year 2022. As explained in greater detail under Item 1 (Business) above, these acquisitions, investments and transactions include:

20

In addition, in December 2022 we also announced our agreements to acquire Producers and Performance Proppants for approximately $35.0 million and $475.0 million, respectively, in total consideration value. Both transactions are now closed.

For a company of our size and resources, the pace and volume of the deal-making activity described above may create risks and uncertainties that can have a material adverse effect on the daily conduct of our business, and negatively impact our cash flows, financial condition and results of operations. For example, we are exposed to the risk that the day-to-day management, oversight, and operation of our business and our financial results may be adversely affected by:

In addition, because the historical utilization rates of any acquired assets may be lower than ours in recent periods, our utilization ratio could decrease during the course of an initial integration period. Accordingly, there can be no assurance the utilization for acquired assets will align with the utilization of our existing fleet or on our anticipated timeline or at all.

We have incurred and will continue to incur substantial indebtedness to finance acquisitions. We have also issued equity and may issue additional equity, or convertible securities in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition, and the issuance of additional equity or convertible securities could be dilutive to our existing shareholders.

Our growth and vertical integration objectives require substantial capital that we may be unable to obtain, or may only obtain at a cost or under terms that adversely affect our cash flows, financial condition and results of operations.

We have historically financed capital expenditures primarily with cash generated by operations, equipment and vendor financing, and borrowings under our credit facilities and other debt financing. As of the date of this annual report, however, the continued reliability of our traditional sources of funding has to be questioned. Any further disruptions or continuing volatility in the global financial markets (including as a result of a potential U.S. government default) may lead to additional increases in interest rates, or to a contraction in credit availability that could impair our ability to finance our operations and acquisitions. In the event our capital expenditure requirements at any time are greater than the amounts then available to us, we may not be able to obtain funding from such alternative sources of capital, and may be required to curtail or eliminate contemplated activities. Even if we can obtain capital from alternative sources, the terms of such fundings may not be favorable to us. In particular, the terms of any debt financing may include covenants that significantly restrict our operations. Our inability to grow as planned may reduce our chances of maintaining and improving profitability.

We may have difficulty managing growth in our business, which could adversely affect our financial condition and results of operations.

Growth in accordance with our business strategy, if achieved, could place a significant strain on our financial, operational and management resources. As we expand the scope of our activities and our geographic coverage through both organic growth and acquisitions, there will be additional demands on our financial, legal, accounting, technical, operational and management resources. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrence of unexpected expansion difficulties, including the failure to recruit and retain experienced managers and other professionals, could have a material adverse effect on our business, liquidity positions, financial condition, results of operations and prospects and our ability to successfully or timely execute our business strategy.

We may experience difficulties in integrating acquired assets into our business and in realizing the expected benefits of an acquisition.

The success of an acquisition, if achieved, will depend in part on our ability to realize anticipated business opportunities and benefits from combining the acquired assets with our business in an effective and efficient manner. The integration process could take longer than anticipated and could result in the loss of key employees, the disruption of each company’s ongoing businesses, tax costs or inefficiencies or inconsistencies in standards, controls, information technology systems, procedures and policies, any of which could adversely affect our ability to maintain relationships with customers, employees or third parties or our ability to achieve the anticipated benefits, and could harm our financial performance. If we are unable to successfully or timely integrate acquired assets with our business, we may incur unanticipated liabilities and be unable to realize the anticipated benefits, and our business, results of operations and financial condition could be materially and adversely affected.

21

Our indebtedness and liquidity needs could restrict our operations and make us more vulnerable to adverse economic conditions.

Our existing and future indebtedness, whether incurred in connection with acquisitions, operations or otherwise, and limited access to liquidity may adversely affect our operations and limit our growth, and we may have difficulty making debt service payments on such indebtedness as payments become due. Our level of indebtedness may affect our operations in several ways, including:

In addition, any failure to comply with the financial or other debt covenants could result in an event of default, which could result in some or all of our indebtedness becoming immediately due and payable. That occurrence would substantially and adversely affect our ability to continue operating our business and would severely and adversely affect our cash flows and financial condition and results.

We may not be able to generate sufficient cash flow to service all of our obligations, including our obligations under our credit and other financing facilities.

Our ability to make payments on and to upsize our current facilities, refinance any of our outstanding indebtedness, and obtain additional financing, and to fund planned capital expenditures, strategic transactions and expansion efforts will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

Our business may not be able to generate sufficient cash flows from operations, and there is no assurance that future borrowings will be available to us in amounts sufficient to enable us to make payments due on our indebtedness and to fund our other liquidity needs. If this is the case, we will need to refinance all or a portion of our indebtedness on or before maturity, and we cannot assure that we will be able to refinance any of our indebtedness in a timely manner, on commercially reasonable terms, or at all. We may need to implement one or more alternatives, such as reducing or delaying planned expenses and capital expenditures, selling assets, restructuring debt, or obtaining additional equity or debt financing. These financing strategies may not be executed on satisfactory terms, if at all. Our ability to upsize our current facilities, refinance our indebtedness or obtain additional financing, and to do so on commercially reasonable terms, will depend on, among other things, our financial condition at the time, restrictions in agreements governing our indebtedness, and other factors, including the condition of the financial markets and the markets in which we will compete.

If we do not generate sufficient cash flows from operations, and additional borrowings, refinancings or proceeds of asset sales are not available to us, we may not have sufficient cash to enable us to meet all of our obligations.

Risks Related to our Business

Our business and financial performance depends on the level of capital spending by oil and gas companies operating within the areas we service.