Exhibit 99.2 M&A and Strategy Update w w w . P F H o l d i n g s C o r p . c o m D e c e m b e r 2 7 , 2 0 2 2

2 Safe Harbor Forward Looking Statement Certain statements in this presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. In some cases, the reader can identify forward-looking statements by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. Forward-looking statements relate to future events or ProFrac’s future financial or operating performance. These forward-looking statements include, among other things, statements regarding: ProFrac’s strategies and plans for growth; ProFrac’s positioning, resources, capabilities, and expectations for future performance; market and industry expectations; expectations regarding ProFrac’s ability to fund the purchase price of such acquisitions, and any other strategic transactions ProFrac may enter into, in a sufficient and timely manner and without impairing ProFrac’s liquidity position; the expected timing and anticipated benefits of ProFrac’s pending acquisitions of Performance Proppants and REV Energy Services (“REV”) and ProFrac’s recently completed acquisition of Monarch’s Eagle Ford sand mining operations (“Monarch”), including benefits associated with scaling ProFrac’s vertically integrated business model, increasing ProFrac’s sand mining capabilities and sand supply, improving ProFrac’s operational efficiency, capturing proppant and logistics margins, reducing royalty payments and realizing other potential cost savings and increasing value to ProFrac’s customers, and other anticipated benefits of the REV and Performance Proppants acquisitions, including, with (i) respect to REV, ProFrac’s expectation that such acquisition will increase its pressure pumping service capabilities, geographic footprint and active fleet count; expectations regarding ProFrac’s plans and ability to upgrade the fleets to be acquired; and ProFrac’s expectations regarding the funding of the acquisition; and (ii) with respect to Performance Proppants, ProFrac’s expectations regarding benefits associated with scaling ProFrac's vertically integrated business model and increasing its nameplate production capabilities, and ProFrac’s estimates of future nameplate production capacity; expectations about increasing value to customers and realizing potential cost savings and geographic advantages; ProFrac’s expectation that the acquisition will be accretive to ProFrac’s earnings and free cash flow, and that such accretion would occur immediately upon closing; and ProFrac’s expectation that the acquisition can be financed through a combination of cash from operations and potential new capital, including debt financing; other forward-looking statements include the number of frac fleets ProFrac expects to be operational in future periods; the projected value of operational synergies expected to result from ProFrac’s pending acquisitions of Performance Proppants and REV, and from ProFrac’s recently completed acquisition of Monarch; market and industry expectations; any financial or other information based upon or otherwise incorporating judgments or estimates relating to future performance, events or expectations; and any estimates and forecasts of financial and other performance metrics. Such forward-looking statements are based upon assumptions made by ProFrac as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the risk that the proposed REV and Performance Proppants transactions may not be completed in a timely manner or at all; risks relating to the failure to satisfy the conditions to the consummation of ProFrac’s pending acquisitions, including the receipt of certain governmental and regulatory approvals; risks associated with ProFrac's ability to fund the REV and Performance Proppants acquisitions, and any other strategic transactions ProFrac may enter into, which risks include that ProFrac will be unable to secure adequate funding to finance the pending acquisitions and, with respect to Performance Proppants, such transaction is not subject to a financing contingency, there are currently no commitments for any new financing, and ProFrac cannot assure that it will raise any new capital in a sufficient manner, on favorable terms, on a timely basis, or at all; risks relating to ProFrac’s liquidity needs; the risk that Company will not realize the anticipated benefits of the acquired businesses and operations; the failure to operationalize and upgrade, as applicable, the acquired operations, services and assets of REV and Performance Proppants in a timely manner or at all; ProFrac’s ability to effectively scale its operations and integrate acquired services, assets and personnel into its existing business model; ProFrac’s ability to execute its business strategy and plans for growth, including with respect to the integration of Monarch and the completion of the pending acquisitions of Performance Proppants and REV; the failure to operationalize and upgrade, as applicable, the acquired operations, services and assets of REV and Performance Proppants in a timely manner or at all; industry conditions, including fluctuations in supply, demand and prices for ProFrac’s products and services; global and regional economic and financial conditions; the effectiveness of ProFrac’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in ProFrac’s filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth in this presentation will be achieved or that any of the contemplated results of such forward looking statements will be achieved. There may be additional risks about which ProFrac is presently unaware or that ProFrac currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. ProFrac anticipates that subsequent events and developments will cause its assessments to change. However, while ProFrac may elect to update these forward-looking statements at some point in the future, it expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law. Industry and Market Data This presentation has been prepared by ProFrac and includes market data and certain other statistical information from third-party sources. Although we believe these third-party sources are reliable as of their respective dates, we have not independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in these publications. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only; there can be no assurance that such conditions will actually occur. Please also see “Forward-Looking Statements.” C O N F I D E N T I A L A N D P R O P R I E T A R Y

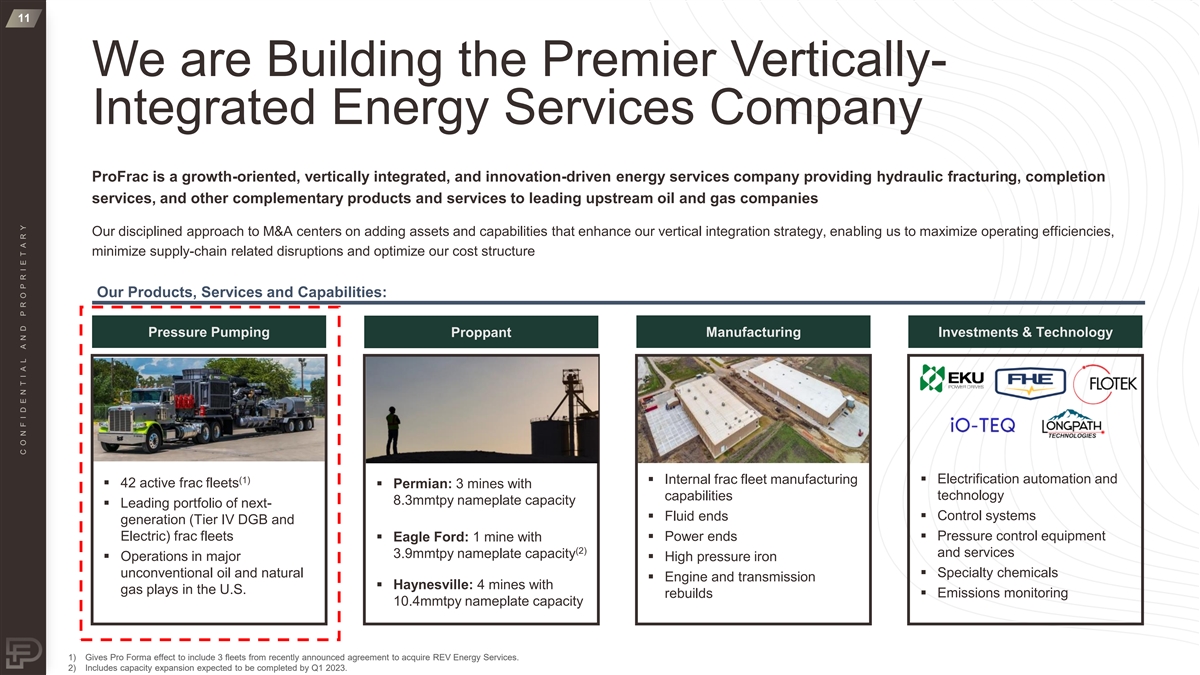

3 We are Building the Premier Vertically- Integrated Energy Services Company ProFrac is a growth-oriented, vertically integrated, and innovation-driven energy services company providing hydraulic fracturing, completion services, and other complementary products and services to leading upstream oil and gas companies Our disciplined approach to M&A centers on adding assets and capabilities that enhance our vertical integration strategy, enabling us to maximize operating efficiencies, minimize supply-chain related disruptions and optimize our cost structure Our Products, Services and Capabilities: Pressure Pumping Proppant Manufacturing Investments & Technology (1)▪ Internal frac fleet manufacturing ▪ Electrification automation and ▪ 42 active frac fleets ▪ Permian: 3 mines with capabilities technology 8.3mmtpy nameplate capacity ▪ Leading portfolio of next- ▪ Control systems ▪ Fluid ends generation (Tier IV DGB and Electric) frac fleets▪ Eagle Ford: 1 mine with ▪ Power ends▪ Pressure control equipment (2) and services 3.9mmtpy nameplate capacity ▪ Operations in major ▪ High pressure iron unconventional oil and natural ▪ Specialty chemicals ▪ Engine and transmission ▪ Haynesville: 4 mines with gas plays in the U.S. ▪ Emissions monitoring rebuilds 10.4mmtpy nameplate capacity 1) Gives Pro Forma effect to include 3 fleets from recently announced agreement to acquire REV Energy Services. 2) Includes capacity expansion expected to be completed by Q1 2023. C O N F I D E N T I A L A N D P R O P R I E T A R Y

4 M&A Enhances Vertical Integration Strategy ProFrac has entered into an agreement to acquire Performance Proppants in an all-cash transaction for $475 million ▪ Acquisition expected to add 10.4 million tons of nameplate production capacity in the Haynesville ▪ ProFrac plans to finance transaction with cash from operations and debt financing ▪ Transaction is expected to close in Q1 2023 Performance Proppants Offers Scale and Access in the Haynesville ─ ProFrac currently operates six active frac fleets in the Haynesville and has strong commercial relationships with customers operating in the basin ─ Performance currently operates four mines located in Bossier City, LA; Doddridge, AR; Merryville, LA; and Shreveport, LA ─ Performance mines offer strategic access to concentrated areas of drilling and completion activity, with facilities as close as 30 miles from key customers ─ Combination of internal manufacturing capabilities and proppant production offers ProFrac advantaged cost structure in a basin known for demanding job requirements with high treating pressures and large proppant loadings C O N F I D E N T I A L A N D P R O P R I E T A R Y

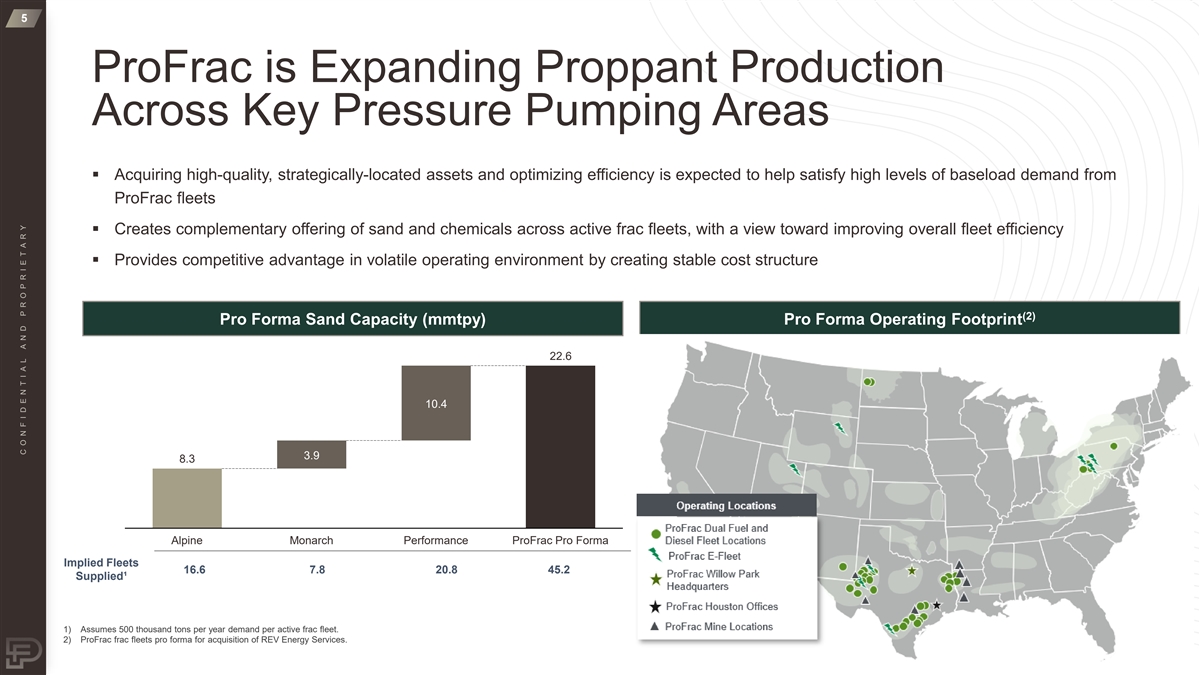

5 ProFrac is Expanding Proppant Production Across Key Pressure Pumping Areas ▪ Acquiring high-quality, strategically-located assets and optimizing efficiency is expected to help satisfy high levels of baseload demand from ProFrac fleets ▪ Creates complementary offering of sand and chemicals across active frac fleets, with a view toward improving overall fleet efficiency ▪ Provides competitive advantage in volatile operating environment by creating stable cost structure (2) Pro Forma Sand Capacity (mmtpy) Pro Forma Operating Footprint 22.6 10.4 3.9 8.3 Alpine Monarch Performance ProFrac Pro Forma Implied Fleets 16.6 7.8 20.8 45.2 Supplied¹ 1) Assumes 500 thousand tons per year demand per active frac fleet. 2) ProFrac frac fleets pro forma for acquisition of REV Energy Services. C O N F I D E N T I A L A N D P R O P R I E T A R Y

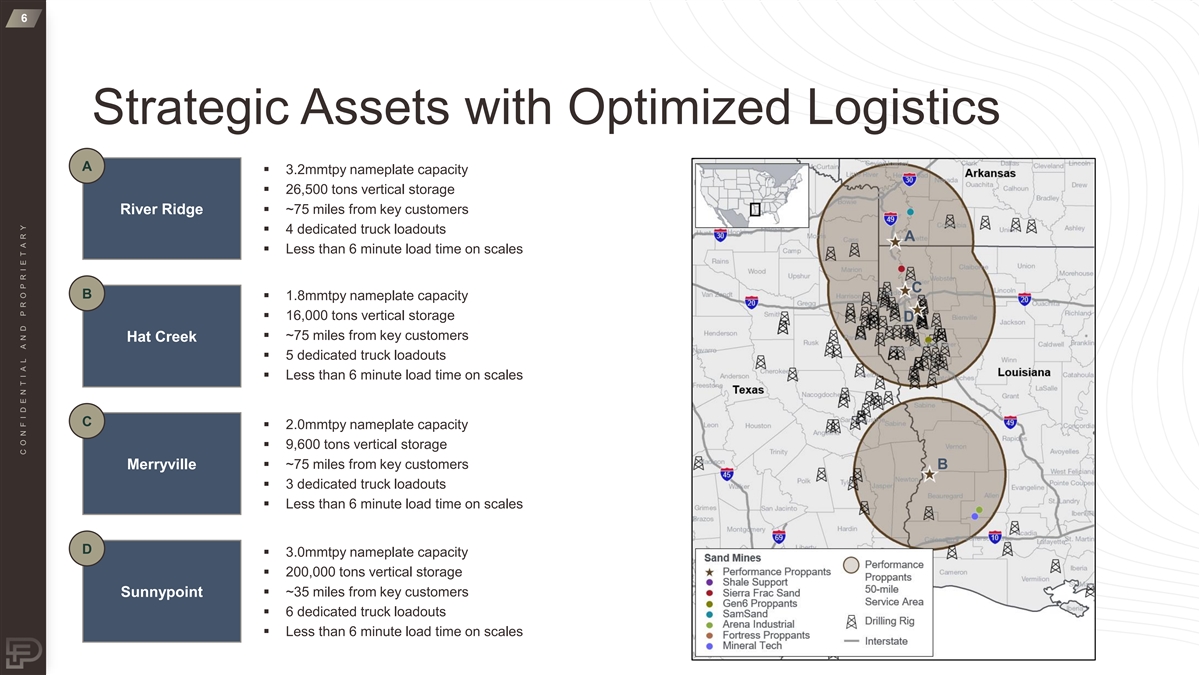

6 Strategic Assets with Optimized Logistics A ▪ 3.2mmtpy nameplate capacity ▪ 26,500 tons vertical storage ▪ ~75 miles from key customers River Ridge ▪ 4 dedicated truck loadouts A ▪ Less than 6 minute load time on scales C B ▪ 1.8mmtpy nameplate capacity ▪ 16,000 tons vertical storage D ▪ ~75 miles from key customers Hat Creek ▪ 5 dedicated truck loadouts ▪ Less than 6 minute load time on scales C ▪ 2.0mmtpy nameplate capacity ▪ 9,600 tons vertical storage ▪ ~75 miles from key customers Merryville B ▪ 3 dedicated truck loadouts ▪ Less than 6 minute load time on scales D ▪ 3.0mmtpy nameplate capacity ▪ 200,000 tons vertical storage ▪ ~35 miles from key customers Sunnypoint ▪ 6 dedicated truck loadouts ▪ Less than 6 minute load time on scales C O N F I D E N T I A L A N D P R O P R I E T A R Y

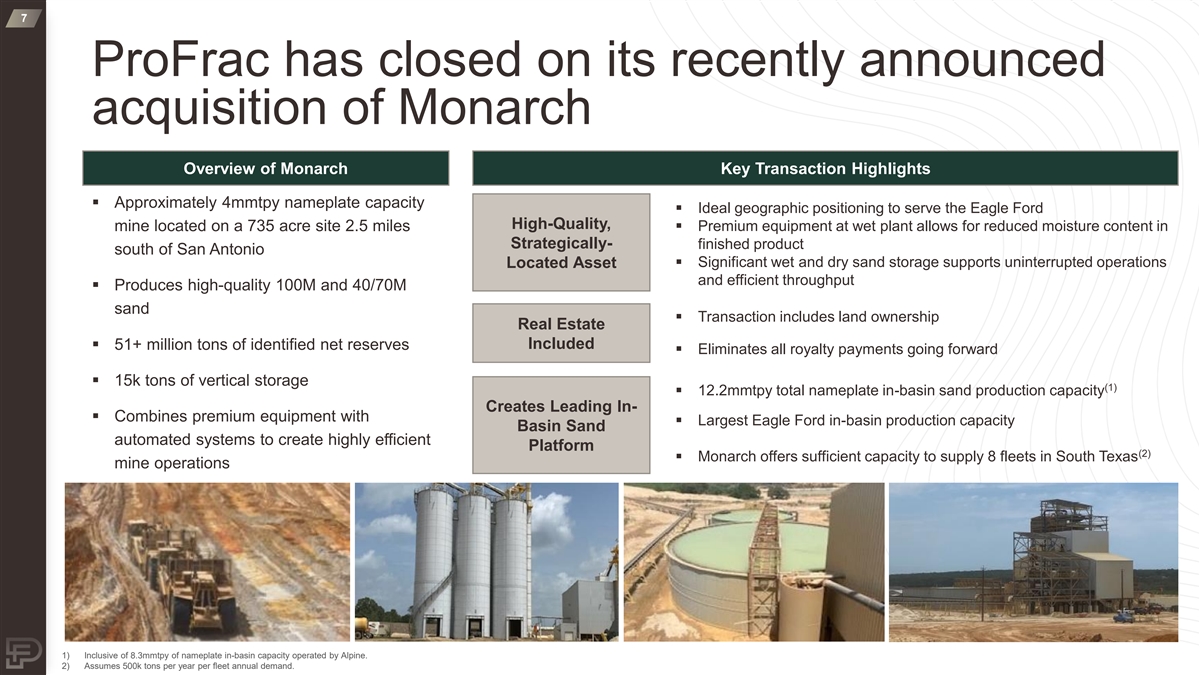

7 ProFrac has closed on its recently announced acquisition of Monarch Overview of Monarch Key Transaction Highlights ▪ Approximately 4mmtpy nameplate capacity ▪ Ideal geographic positioning to serve the Eagle Ford High-Quality, mine located on a 735 acre site 2.5 miles ▪ Premium equipment at wet plant allows for reduced moisture content in Strategically- finished product south of San Antonio ▪ Significant wet and dry sand storage supports uninterrupted operations Located Asset and efficient throughput ▪ Produces high-quality 100M and 40/70M sand ▪ Transaction includes land ownership Real Estate Included ▪ 51+ million tons of identified net reserves ▪ Eliminates all royalty payments going forward ▪ 15k tons of vertical storage (1) ▪ 12.2mmtpy total nameplate in-basin sand production capacity Creates Leading In- ▪ Combines premium equipment with ▪ Largest Eagle Ford in-basin production capacity Basin Sand automated systems to create highly efficient Platform (2) ▪ Monarch offers sufficient capacity to supply 8 fleets in South Texas mine operations 1) Inclusive of 8.3mmtpy of nameplate in-basin capacity operated by Alpine. 2) Assumes 500k tons per year per fleet annual demand.

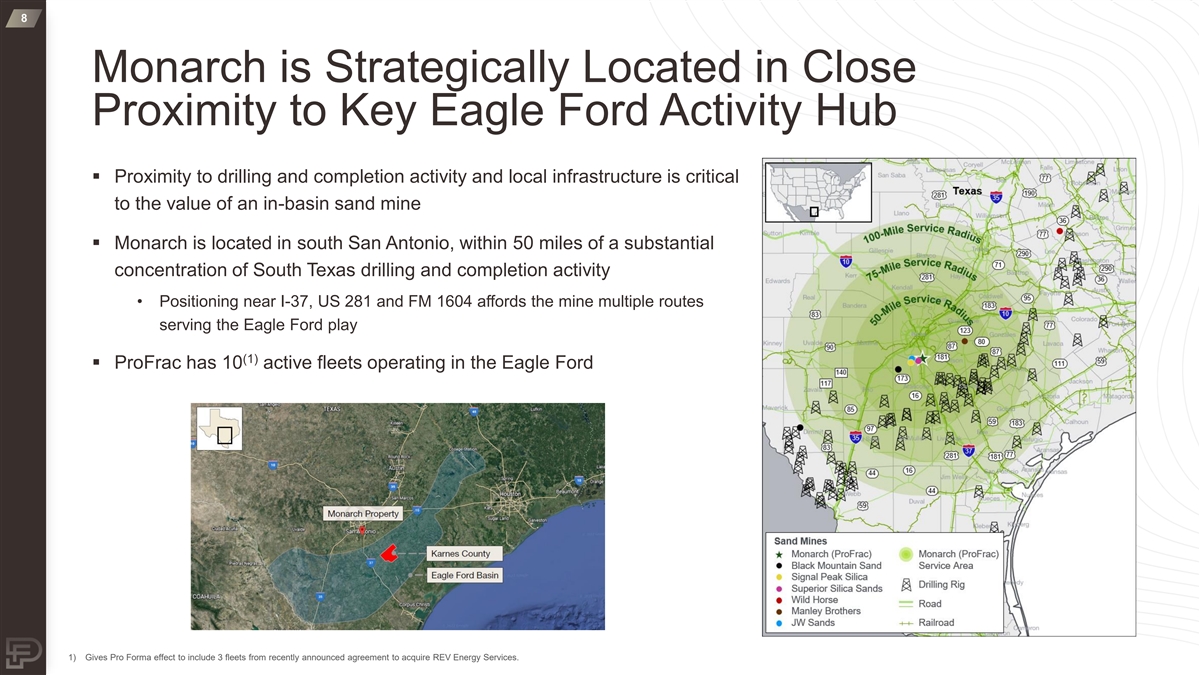

8 Monarch is Strategically Located in Close Proximity to Key Eagle Ford Activity Hub ▪ Proximity to drilling and completion activity and local infrastructure is critical to the value of an in-basin sand mine ▪ Monarch is located in south San Antonio, within 50 miles of a substantial concentration of South Texas drilling and completion activity • Positioning near I-37, US 281 and FM 1604 affords the mine multiple routes serving the Eagle Ford play (1) ▪ ProFrac has 10 active fleets operating in the Eagle Ford 1) Gives Pro Forma effect to include 3 fleets from recently announced agreement to acquire REV Energy Services.

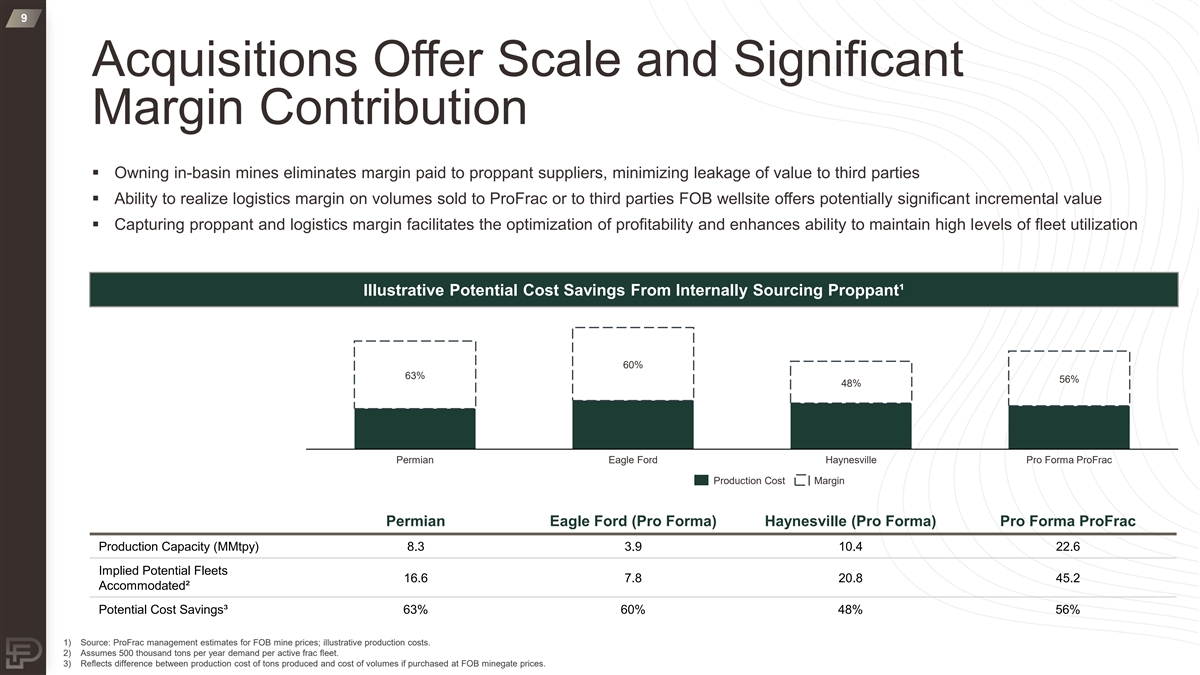

9 Acquisitions Offer Scale and Significant Margin Contribution ▪ Owning in-basin mines eliminates margin paid to proppant suppliers, minimizing leakage of value to third parties ▪ Ability to realize logistics margin on volumes sold to ProFrac or to third parties FOB wellsite offers potentially significant incremental value ▪ Capturing proppant and logistics margin facilitates the optimization of profitability and enhances ability to maintain high levels of fleet utilization Illustrative Potential Cost Savings From Internally Sourcing Proppant¹ 60% 63% 56% 48% Permian Eagle Ford Haynesville Pro Forma ProFrac Production Cost Margin Permian Eagle Ford (Pro Forma) Haynesville (Pro Forma) Pro Forma ProFrac Production Capacity (MMtpy) 8.3 3.9 10.4 22.6 Implied Potential Fleets 16.6 7.8 20.8 45.2 Accommodated² Potential Cost Savings³ 63% 60% 48% 56% 1) Source: ProFrac management estimates for FOB mine prices; illustrative production costs. 2) Assumes 500 thousand tons per year demand per active frac fleet. 3) Reflects difference between production cost of tons produced and cost of volumes if purchased at FOB minegate prices.

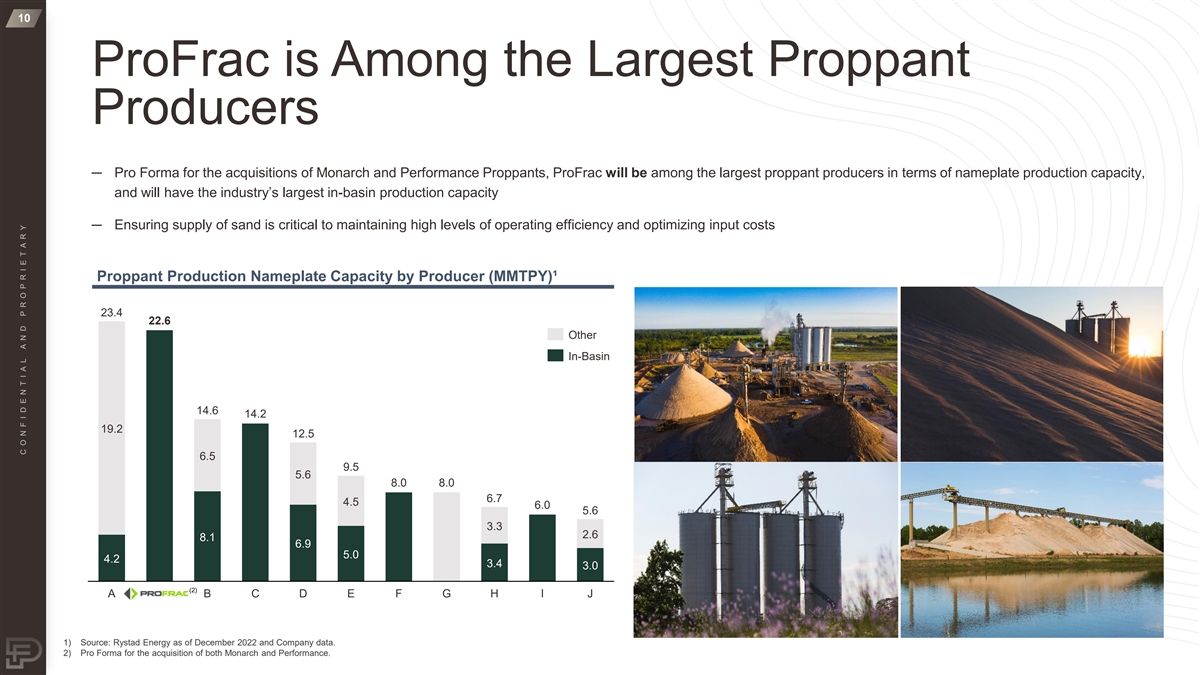

10 ProFrac is Among the Largest Proppant Producers ─ Pro Forma for the acquisitions of Monarch and Performance Proppants, ProFrac will be among the largest proppant producers in terms of nameplate production capacity, and will have the industry’s largest in-basin production capacity ─ Ensuring supply of sand is critical to maintaining high levels of operating efficiency and optimizing input costs Proppant Production Nameplate Capacity by Producer (MMTPY)¹ 23.4 22.6 Other In-Basin 14.6 14.2 19.2 12.5 6.5 9.5 5.6 8.0 8.0 6.7 4.5 6.0 5.6 3.3 2.6 8.1 6.9 5.0 4.2 3.4 3.0 (2) A B C D E F G H I J 1) Source: Rystad Energy as of December 2022 and Company data. 2) Pro Forma for the acquisition of both Monarch and Performance. C O N F I D E N T I A L A N D P R O P R I E T A R Y

11 We are Building the Premier Vertically- Integrated Energy Services Company ProFrac is a growth-oriented, vertically integrated, and innovation-driven energy services company providing hydraulic fracturing, completion services, and other complementary products and services to leading upstream oil and gas companies Our disciplined approach to M&A centers on adding assets and capabilities that enhance our vertical integration strategy, enabling us to maximize operating efficiencies, minimize supply-chain related disruptions and optimize our cost structure Our Products, Services and Capabilities: Pressure Pumping Proppant Manufacturing Investments & Technology (1)▪ Internal frac fleet manufacturing ▪ Electrification automation and ▪ 42 active frac fleets ▪ Permian: 3 mines with capabilities technology 8.3mmtpy nameplate capacity ▪ Leading portfolio of next- ▪ Control systems ▪ Fluid ends generation (Tier IV DGB and Electric) frac fleets▪ Eagle Ford: 1 mine with ▪ Power ends▪ Pressure control equipment (2) and services 3.9mmtpy nameplate capacity ▪ Operations in major ▪ High pressure iron unconventional oil and natural ▪ Specialty chemicals ▪ Engine and transmission ▪ Haynesville: 4 mines with gas plays in the U.S. ▪ Emissions monitoring rebuilds 10.4mmtpy nameplate capacity 1) Gives Pro Forma effect to include 3 fleets from recently announced agreement to acquire REV Energy Services. 2) Includes capacity expansion expected to be completed by Q1 2023. C O N F I D E N T I A L A N D P R O P R I E T A R Y

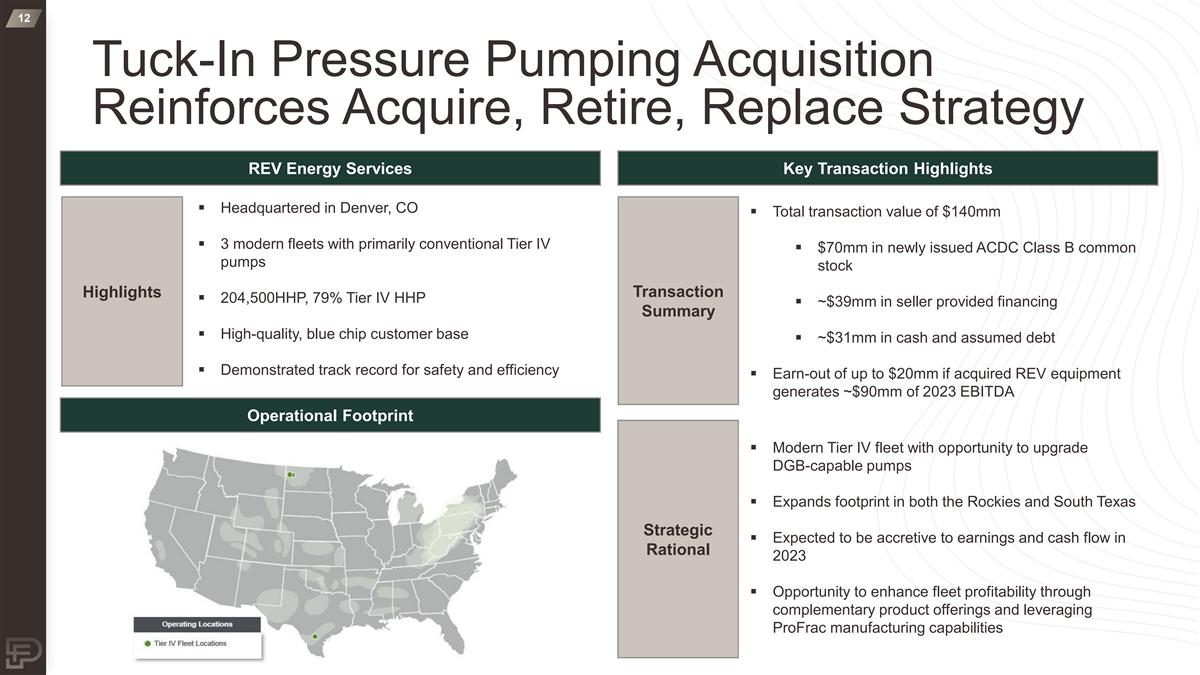

12 Tuck-In Pressure Pumping Acquisition Reinforces Acquire, Retire, Replace Strategy REV Energy Services Key Transaction Highlights ▪ Headquartered in Denver, CO ▪ Total transaction value of $140mm ▪ 3 modern fleets with primarily conventional Tier IV ▪ $70mm in newly issued ACDC Class B common pumps stock Highlights Transaction ▪ 204,500HHP, 79% Tier IV HHP ▪ ~$39mm in seller provided financing Summary ▪ High-quality, blue chip customer base ▪ ~$31mm in cash and assumed debt ▪ Demonstrated track record for safety and efficiency ▪ Earn-out of up to $20mm if acquired REV equipment generates ~$90mm of 2023 EBITDA Operational Footprint ▪ Modern Tier IV fleet with opportunity to upgrade DGB-capable pumps ▪ Expands footprint in both the Rockies and South Texas Strategic ▪ Expected to be accretive to earnings and cash flow in Rational 2023 ▪ Opportunity to enhance fleet profitability through complementary product offerings and leveraging ProFrac manufacturing capabilities

13 ProFrac Investment Highlights High Performing Pressure Pumping Fleets that have Consistently Outperformed Peers Focused on Cash Flow and Efficiency ✓ Vertically Integrated Platform with In-House Manufacturing and Sand Production Enhance Efficiency and Profitability by Controlling More of the Pad ✓ Operational Philosophy Underpinned by ESG-Focused Initiatives Environmental & Economic Improvements Aligned ✓ Two-Pronged Growth Strategy: Acquire/Retire/Replace & Scaling Vertical Integration We’re Not Building An OFS Company, We’re Building an Oil & Gas Institution ✓ Diversified Exposure to Oil and Gas Basins with a Loyal and Active Customer Base Value Add Business Partner with Significant Market Share ✓ Premier Management Team with Established Track Record We Know Frac ✓