The information in this proxy statement/information statement/prospectus is not complete and may be changed. ProFrac Holding Corp. may not issue the securities offered by this proxy statement/information statement/prospectus until the registration statement containing this proxy statement/information statement/prospectus has been declared effective by the Securities and Exchange Commission. This proxy statement/information statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

PROXY STATEMENT/INFORMATION STATEMENT/PROSPECTUS

SUBJECT TO COMPLETION, DATED AUGUST

30

, 2022

NOTICE OF ACTION BY WRITTEN CONSENT AND INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

To the Stockholders of ProFrac Holding Corp.:

This notice of action by written consent and the accompanying proxy statement/information statement/prospectus are being furnished to holders of the Class A Common Stock, $0.01 per share par value (“”), and Class B Common Stock, $0.01 per share par value (“”), of ProFrac Holding Corp., a Delaware corporation (“”).

ProFrac Class

A Common Stock

ProFrac Class

B Common Stock

ProFrac

On June 21, 2022, ProFrac entered into an Agreement and Plan of Merger (the “”) by and among ProFrac, U.S. Well Services, Inc., a Delaware corporation (“”), and Thunderclap Merger Sub I, Inc., a Delaware corporation and an indirect subsidiary of ProFrac (“”). The Merger Agreement provides for, among other things, the merger of Merger Sub with and into USWS, with USWS surviving the merger as the surviving corporation and an indirect subsidiary of ProFrac (the “”). A copy of the Merger Agreement is included as

Merger Agreement

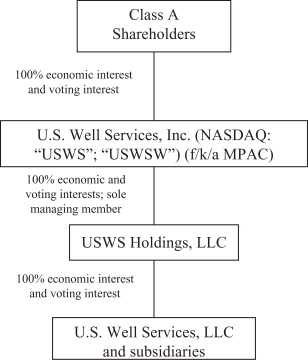

USWS

Merger Sub

Merger

Annex A

to the accompanying proxy statement/information statement/prospectus. Pursuant to the Merger Agreement, subject to the terms and conditions set forth therein:

• |

At the effective time of the Merger (the “ Effective Time USWS Common Stock Exchange Ratio Merger Consideration 1-for-6 |

• |

USWS will take all requisite action so that, effective as of immediately prior to the Effective Time, all shares of Series A Redeemable Convertible Preferred Stock of USWS, par value $0.0001 per share (the “ USWS Series A Preferred Stock The Merger Agreement — Treatment of USWS Series A Preferred Stock and Treatment of USWS Equity Linked Convertible Notes |

• |

Subject to the consummation of the Warrant Sale (as defined in the accompanying proxy statement/information statement/prospectus), at the Effective Time, the USWS Term C Loan Warrants (as defined in the accompanying proxy statement/information statement/prospectus) issued and outstanding immediately prior to the Effective Time (which shall be held by ProFrac following the consummation of the Warrant Sale) will be automatically canceled and will cease to exist and no consideration will be delivered in exchange therefor. For more information about the Warrant Sale, see the section titled “ The Merger Agreement — Related Agreements |