Filed by ProFrac Holding Corp.

Pursuant to Rule 425 under the

Securities Act of 1933 and deemed

filed pursuant to Rule 14a-12 of

the Securities Exchange Act of 1934

Subject Company: U.S. Well Services, Inc.

Commission File No.: 001-38025

Acquisition of U.S. Well Services June 22, 2022 www . pf hol di ngs c or p. c om

2 Disclaimer This presentation (this “Presentation”) contemplates a proposed business combination (the “Proposed Transaction”) involving ProFrac Holding Corp. (“ProFrac”) and U.S. Well Services, Inc. (“USWS”), is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the Proposed Transaction and for not any other purpose. An investment in furtherance of the Proposed Transaction should be made only after careful review of the information contained herein and in any other offering materials related to the Proposed Transaction. No Representations or Warranties The information contained herein does not purport to be all-inclusive and none of ProFrac, USWS or their respective affiliates makes any representation or warranty, express or implied, in respect of this Presentation, including any representations or warranties as to the accuracy, completeness or reliability of the information contained in this Presentation. The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should inform themselves about and observe any such restrictions. Upon receipt of this Presentation, you acknowledge that you are familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. You are also being advised that the United States securities laws restrict persons with material non-public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances in which in is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. To the fullest extent permitted by law, in no circumstances will ProFrac, USWS, or any of their respective subsidiaries, stockholders, affiliates, representatives, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purport to be all-inclusive or to contain all o the information that may be required to make a full analysis of USWS or the Proposed Transaction. Viewers of this Presentation should each make their own evaluation of USWS and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Nothing herein shall be construed as legal, financial, tax, accounting, investment or other advice or a recommendation. You should consult your own advisors concerning any legal, financial, tax, accounting, investment or other considerations concerning the opportunity described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. No Offer or Solicitation This Presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of ProFrac, USWS or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. Forward-Looking Statements Certain statements in this Presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. In some cases, the reader can identify forward-looking statements by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. Forward-looking statements relate to future events, or ProFrac’s, USWS’ or the combined company’s future financial or operating performance. These forward-looking statements include, among other things, statements regarding: the expected benefits of the Proposed Transaction, including any resulting synergies and positive impact on earnings, competitive advantages, expanded active fleet and electric fleet portfolio, increased value, improved efficiency, cost savings including fuel cost savings, access to and rights in acquired intellectual property, emissions minimization and other expected advantages of the Proposed Transaction to the combined company; the anticipated timing of the Proposed Transaction; the likelihood and ability of the parties to successfully consummate the Proposed Transaction; the services to be offered by the combined company; the markets in which ProFrac and USWS operate; business strategies, debt levels, industry environment and growth opportunities; and the projected value of operational synergies, including value expected to result from license fee savings; and expectations regarding ProFrac’s ability to financing USWS’ debt. Such forward-looking statements are based upon assumptions made by ProFrac and USWS as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the risk that the Proposed Transaction may not be completed in a timely manner or at all, which may adversely affect the price of ProFrac and USWS securities; the failure to satisfy the conditions to the consummation of the Proposed Transaction, including the approval of the Proposed Transaction by the stockholders of each of ProFrac and USWS, and the receipt of certain governmental and regulatory approvals; the failure by ProFrac to obtain financing necessary to complete the Proposed Transaction on favorable terms or at all; the effect of the announcement or pendency of the Proposed Transaction on ProFrac’s and USWS’ business relationships, performance, and business generally; risks that the Proposed Transaction disrupts current plans of ProFrac or USWS and may cause potential difficulties in employee retention as a result of the Proposed Transaction; the outcome of any legal proceedings that may be instituted against ProFrac or USWS or any of their affiliates related to the agreement and the Proposed Transaction; changes to the proposed structure of the Proposed Transaction that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Proposed Transaction; the impact on the price of ProFrac’s and USWS’ securities, including volatility resulting from changes in the competitive and highly regulated industries in which ProFrac and USWS operate, variations in performance across competitors, changes in laws and regulations affecting ProFrac’s and USWS’ businesses and changes in the combined capital structure; the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Transaction, and identify and realize additional opportunities; the ability to integrate acquired assets and personnel into ProFrac’s existing business model and realize the expected value of resulting operational synergies; the ability to successfully and sustainably execute on current business strategies and plans for growth; and other risks and uncertainties set forth in the section entitled “Risk Factors” in ProFrac’s final prospectus relating to its initial public offering (File No. 333-261255) declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on May 12, 2022, and in the section entitled “Risk Factors” in Part I, Item 1A of USWS’ annual report on Form 10- K, filed with the SEC on March 30, 2022, and in the other filings ProFrac and USWS make with the SEC. The foregoing list of factors is not exhaustive. There may be additional risks that neither ProFrac nor USWS presently know or that ProFrac or USWS currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the Proxy Materials (as defined below), including those under “Risk Factors” therein, and other documents filed by ProFrac and USWS from time to time with the SEC, which are available on the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved, including without limitation any expectations about ProFrac’s, USWS’ or the combined company’s operational and financial performance or achievements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and ProFrac and USWS assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither ProFrac nor USWS gives any assurance that either ProFrac or USWS will achieve its expectations, including that the Proposed Transaction will be consummated.

3 Disclaimer (continued) Use of Projections This Presentation contains financial forecasts with respect to the combined company’s projected financial results. Neither ProFrac’s nor USWS’ independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Presentation. These projections should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of ProFrac, USWS or the combined company or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Additional Information and Where to Find It In connection with the Proposed Transaction, ProFrac and USWS will jointly prepare, and ProFrac will file with the with the SEC a registration statement on Form S-4, which will include a proxy statement/prospectus (the “Proxy Statement”) and an information statement (the “Information Statement” and together with the Proxy Statement, the “Proxy Materials”). PROFRAC AND USWS URGE INVESTORS TO READ THE PROXY STATEMENT AND THE INFORMATION STATEMENT CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PROFRAC, USWS AND THE PROPOSED TRANSACTION. Investors may obtain free copies of the Proxy Materials (when available) as well as other filed documents containing information about ProFrac at http://www.sec.gov, the SEC’s free website. Free copies of ProFrac’s SEC filings including the Proxy Materials (when available) are also available on ProFrac’s internet website at www.pfholdingscorp.com under “Investor Relations.” Free copies of USWS’ SEC filings including the Proxy Materials (when available) are also available on USWS’ website at www.uswellservices.com under “Investor Relations.” Participants in the Solicitation ProFrac and USWS and their respective executive officers and directors may be deemed, under SEC rules, to be participants in the solicitation of proxies in connection with the Proposed Transaction. Information regarding the officers and directors of ProFrac is included in the final prospectus filed pursuant to Rule 424(b) with the SEC on May 16, 2022. Information regarding the officers and directors of USWS is included in the Definitive Proxy Statement on Schedule 14A filed with the SEC on April 20, 2022, as amended from time to time, with respect to the 2022 Annual Meeting of Stockholders of USWS. More detailed information regarding the identity of the potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Materials and other materials to be filed with the SEC in connection with the Proposed Transaction. No Offer and Non-Solicitation This Presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposed Transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of ProFrac, USWS or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

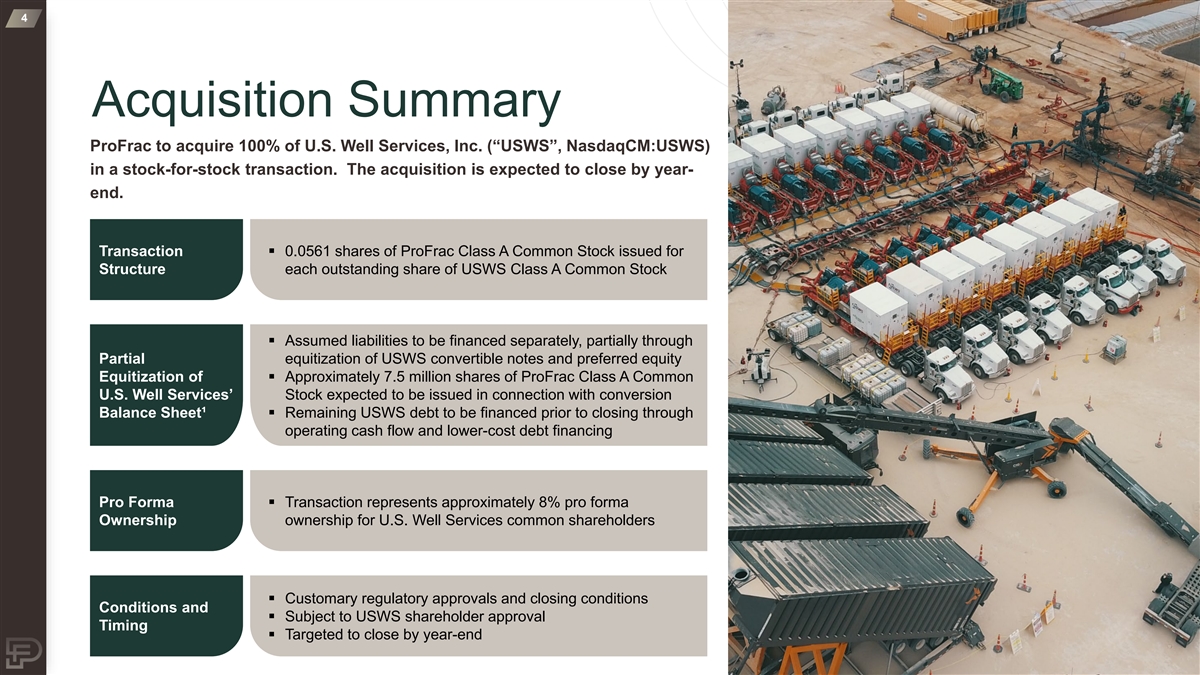

4 Acquisition Summary ProFrac to acquire 100% of U.S. Well Services, Inc. (“USWS”, NasdaqCM:USWS) in a stock-for-stock transaction. The acquisition is expected to close by year- end. Transaction § 0.0561 shares of ProFrac Class A Common Stock issued for Structure each outstanding share of USWS Class A Common Stock § Assumed liabilities to be financed separately, partially through Partial equitization of USWS convertible notes and preferred equity Equitization of § Approximately 7.5 million shares of ProFrac Class A Common U.S. Well Services’ Stock expected to be issued in connection with conversion Balance Sheet¹§ Remaining USWS debt to be financed prior to closing through operating cash flow and lower-cost debt financing Pro Forma § Transaction represents approximately 8% pro forma Ownership ownership for U.S. Well Services common shareholders § Customary regulatory approvals and closing conditions Conditions and § Subject to USWS shareholder approval Timing § Targeted to close by year-end

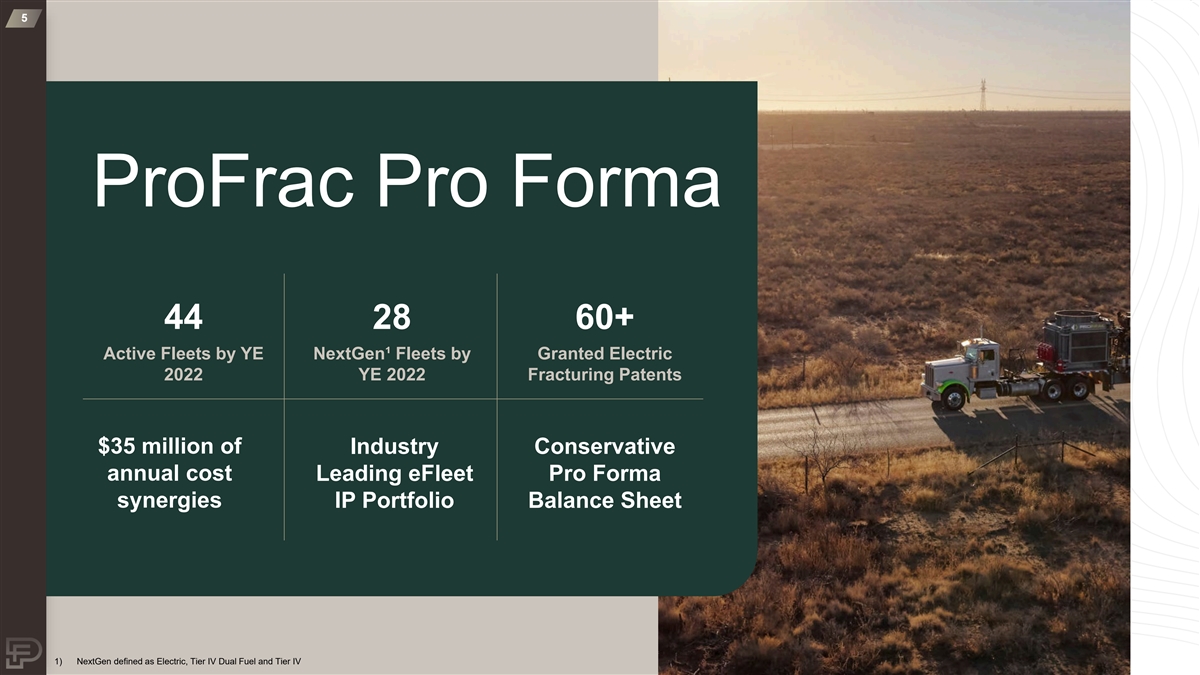

5 ProFrac Pro Forma 44 28 60+ Active Fleets by YE NextGen¹ Fleets by Granted Electric 2022 YE 2022 Fracturing Patents $35 million of Industry Conservative annual cost Leading eFleet Pro Forma synergies IP Portfolio Balance Sheet 1) NextGen defined as Electric, Tier IV Dual Fuel and Tier IV

6 Strategic Rationale The acquisition of U.S. Well Services introduces an opportunity to expand ProFrac’s NextGen frac assets and capabilities while revealing considerable value from scale, supply chain expertise and commercial opportunities Delivering on Strategy Significant Upside Intellectual Property Financially Attractive Expands the Company’s Combines leading edge Provides unlimited access to Combined company expected to portfolio to 44 active fleets by efficiency and cost structure expansive intellectual property maintain a conservative balance YE 2022, including 28 NextGen, from ProFrac with top electric portfolio, including over 60 and sheet low-emissions fleets fleet platform to deliver best-in- 200 granted and pending Eliminates all license fees going class profitability for PFHC and patents, respectively forward unrivaled cost savings to customers

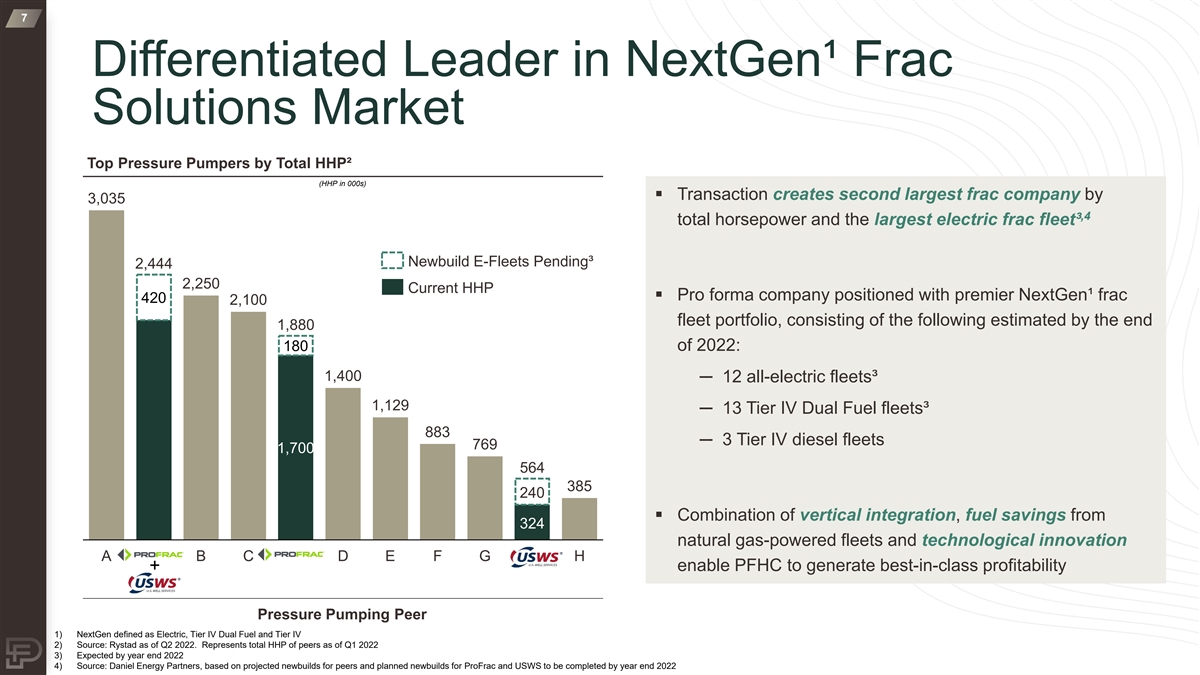

7 Differentiated Leader in NextGen¹ Frac Solutions Market Top Pressure Pumpers by Total HHP² (HHP in 000s) § Transaction creates second largest frac company by 3,035 ,4 total horsepower and the largest electric frac fleet³ Newbuild E-Fleets Pending³ 2,444 2,250 Current HHP § Pro forma company positioned with premier NextGen¹ frac 420 2,100 fleet portfolio, consisting of the following estimated by the end 1,880 180 of 2022: 1,400 ─ 12 all-electric fleets³ 1,129 ─ 13 Tier IV Dual Fuel fleets³ 883 ─ 3 Tier IV diesel fleets 769 1,700 564 385 240 § Combination of vertical integration, fuel savings from 324 natural gas-powered fleets and technological innovation A B C D E F G H enable PFHC to generate best-in-class profitability + Pressure Pumping Peer 1) NextGen defined as Electric, Tier IV Dual Fuel and Tier IV 2) Source: Rystad as of Q2 2022. Represents total HHP of peers as of Q1 2022 3) Expected by year end 2022 4) Source: Daniel Energy Partners, based on projected newbuilds for peers and planned newbuilds for ProFrac and USWS to be completed by year end 2022

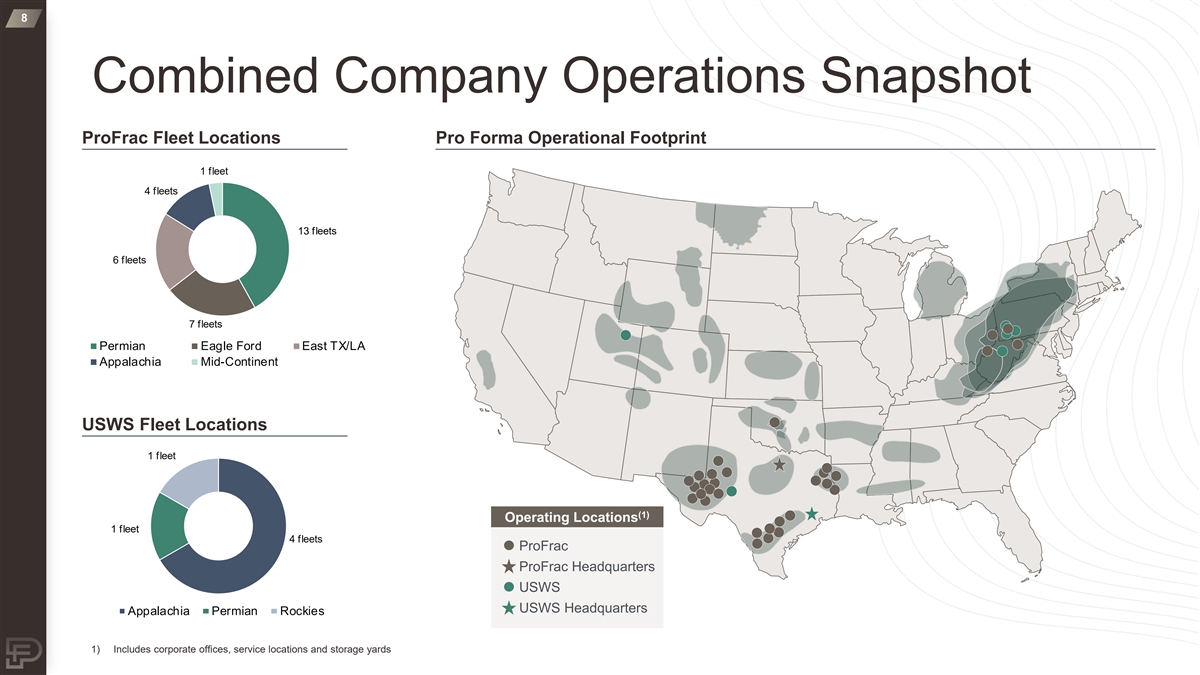

8 Combined Company Operations Snapshot ProFrac Fleet Locations Pro Forma Operational Footprint 1 fleet 4 fleets 13 fleets 6 fleets 7 fleets Permian Eagle Ford East TX/LA Appalachia Mid-Continent USWS Fleet Locations 1 fleet (1) Operating Locations 1 fleet 4 fleets ProFrac ProFrac Headquarters USWS USWS Headquarters Appalachia Permian Rockies 1) Includes corporate offices, service locations and storage yards

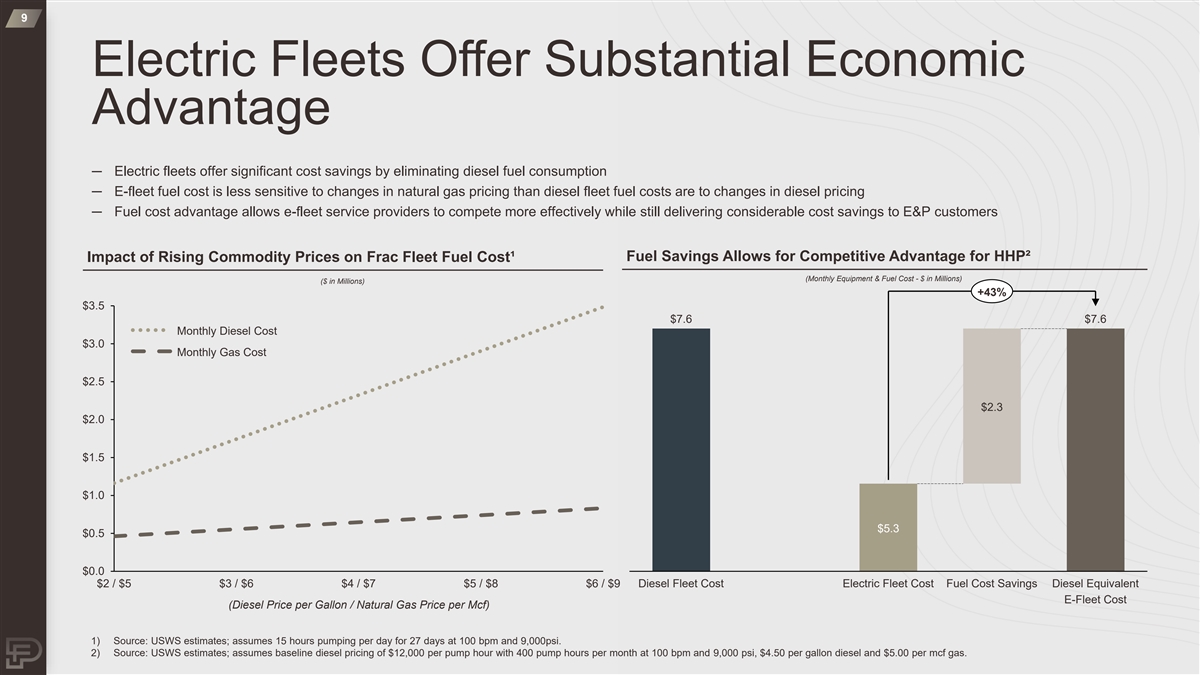

9 Electric Fleets Offer Substantial Economic Advantage ─ Electric fleets offer significant cost savings by eliminating diesel fuel consumption ─ E-fleet fuel cost is less sensitive to changes in natural gas pricing than diesel fleet fuel costs are to changes in diesel pricing ─ Fuel cost advantage allows e-fleet service providers to compete more effectively while still delivering considerable cost savings to E&P customers Fuel Savings Allows for Competitive Advantage for HHP² Impact of Rising Commodity Prices on Frac Fleet Fuel Cost¹ (Monthly Equipment & Fuel Cost - $ in Millions) ($ in Millions) +43% $3.5 $7.6 $7.6 Monthly Diesel Cost $3.0 Monthly Gas Cost $2.5 $2.3 $2.0 $1.5 $1.0 $5.3 $0.5 $0.0 $2 / $5 $3 / $6 $4 / $7 $5 / $8 $6 / $9 Diesel Fleet Cost Electric Fleet Cost Fuel Cost Savings Diesel Equivalent E-Fleet Cost (Diesel Price per Gallon / Natural Gas Price per Mcf) 1) Source: USWS estimates; assumes 15 hours pumping per day for 27 days at 100 bpm and 9,000psi. 2) Source: USWS estimates; assumes baseline diesel pricing of $12,000 per pump hour with 400 pump hours per month at 100 bpm and 9,000 psi, $4.50 per gallon diesel and $5.00 per mcf gas.

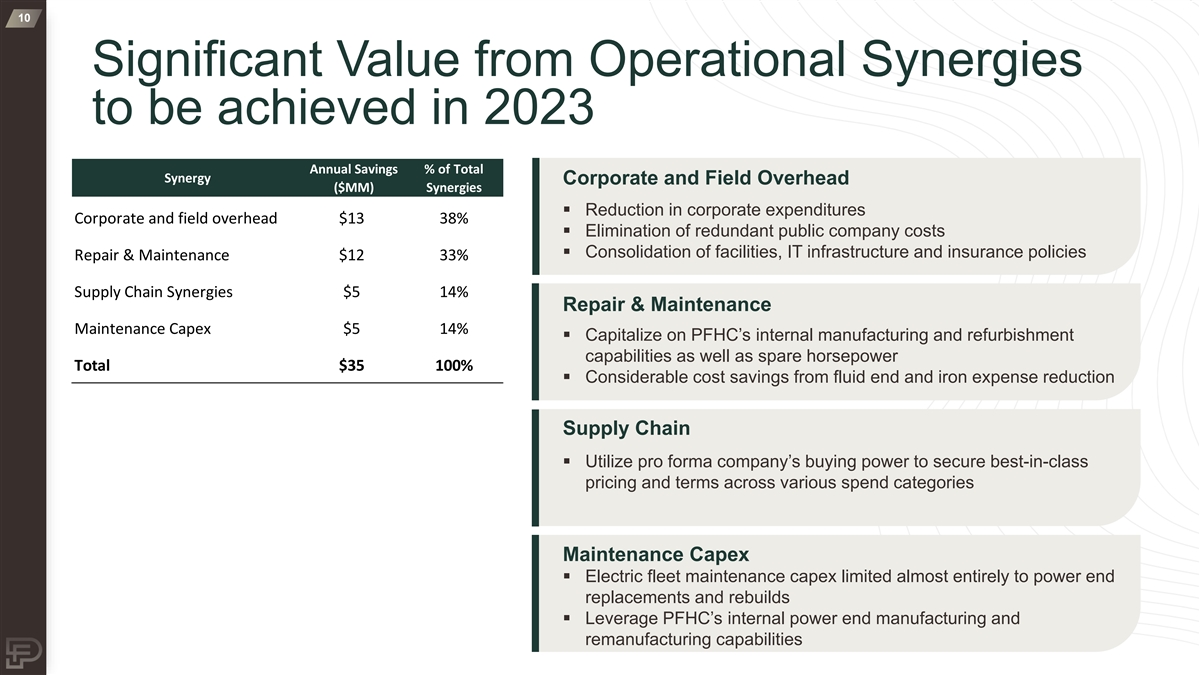

10 Significant Value from Operational Synergies to be achieved in 2023 Annual Savings % of Total Synergy Corporate and Field Overhead ($MM) Synergies § Reduction in corporate expenditures Corporate and field overhead $13 38% § Elimination of redundant public company costs § Consolidation of facilities, IT infrastructure and insurance policies Repair & Maintenance $12 33% Supply Chain Synergies $5 14% Repair & Maintenance Maintenance Capex $5 14% § Capitalize on PFHC’s internal manufacturing and refurbishment capabilities as well as spare horsepower Total $35 100% § Considerable cost savings from fluid end and iron expense reduction Supply Chain § Utilize pro forma company’s buying power to secure best-in-class pricing and terms across various spend categories Maintenance Capex § Electric fleet maintenance capex limited almost entirely to power end replacements and rebuilds § Leverage PFHC’s internal power end manufacturing and remanufacturing capabilities

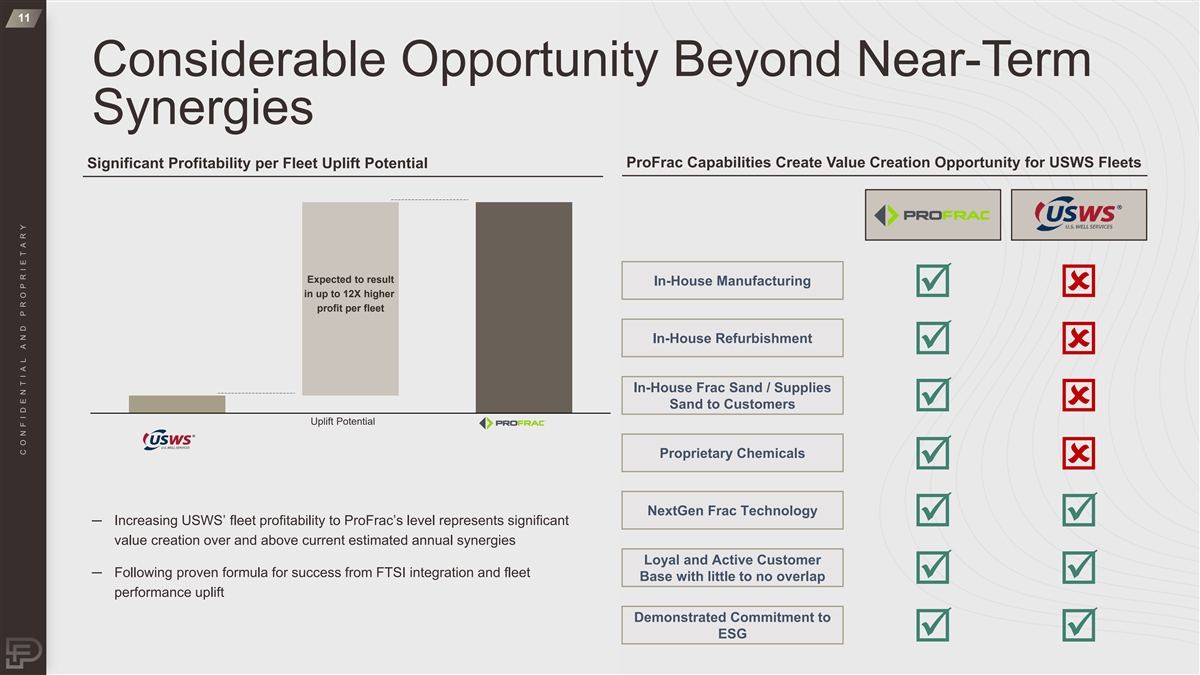

11 Considerable Opportunity Beyond Near-Term Synergies ProFrac Capabilities Create Value Creation Opportunity for USWS Fleets Significant Profitability per Fleet Uplift Potential Expected to result In-House Manufacturing in up to 12X higher þý profit per fleet In-House Refurbishment þý In-House Frac Sand / Supplies Sand to Customers þý Uplift Potential Proprietary Chemicals þý NextGen Frac Technology ─ Increasing USWS’ fleet profitability to ProFrac’s level represents significant þþ value creation over and above current estimated annual synergies Loyal and Active Customer ─ Following proven formula for success from FTSI integration and fleet Base with little to no overlap þþ performance uplift Demonstrated Commitment to ESG þþ CO NF I DE NT I A L A ND P RO P RI E T A RY