The information in this preliminary prospectus is not complete and may be changed. The securities described herein may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy the securities described herein in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated May 11, 2022

Prospectus

16,000,000 shares

ProFrac Holding Corp.

Class A common stock

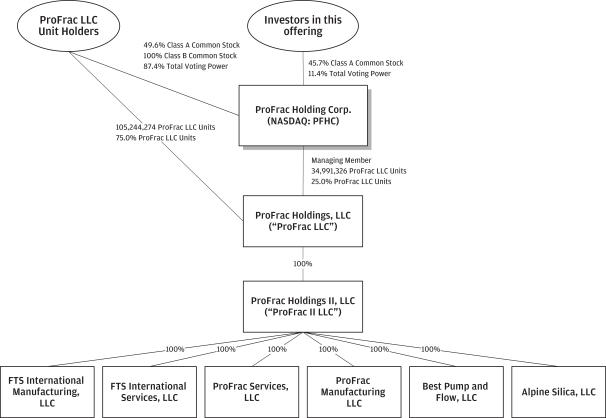

This is our initial public offering. We are offering 16,000,000 shares of our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. It is currently estimated that the initial public offering price will be between $21.00 and $24.00 per share of Class A common stock. We have applied to list our Class A common stock on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “PFHC.”

THRC Holdings, LP (“THRC Holdings”) and the Farris and Jo Ann Wilks 2022 Family Trust have indicated that they may collectively purchase in this offering an aggregate of up to $117.0 million, or 5,200,000 shares (based on the midpoint of the price range set forth above), of our Class A common stock at the price to the public. The underwriters will not receive any underwriting discounts or commissions on any shares sold to such potential purchasers. The number of shares available for sale to the general public will be reduced to the extent such potential purchasers purchase such shares. There can be no assurance that any such purchasers will purchase shares in this offering, and, unless otherwise indicated, the information presented in this prospectus assumes that no such purchasers purchase shares of our Class A common stock in this offering, and when so indicated, assumes THRC Holdings purchases 4,222,222 shares of Class A common stock and the Farris and Jo Ann Wilks 2022 Family Trust purchases 977,778 shares of Class A common stock. See “Underwriting” beginning on page 177.

To the extent that the underwriters sell more than 16,000,000 shares of Class A common stock, the underwriters have the option to purchase, exercisable within 30 days from the date of this prospectus, up to an additional 2,400,000 shares of Class A common stock from us at the public offering price less the underwriting discounts and commissions.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings. See “Risk Factors” and “Summary—Emerging Growth Company.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 37 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to ProFrac Holding Corp. |

$ | $ | ||||||

| (1) | Please read “Underwriting” for a description of all underwriting compensation payable in connection with this offering. |

Delivery of the shares of Class A common stock is expected to be made on or about , 2022.

| J.P. Morgan | Piper Sandler | Morgan Stanley |

| BofA Securities |

Capital One Securities | Johnson Rice & Company L.L.C. |

Seaport Global Securities |

Stifel | ||||

The date of this prospectus is , 2022.