Although the property is not considered high-quality habitat, Alpine has also voluntarily enrolled its owned

surface rights in the Candidate Conservation Agreement with Assurances for the Dune Sagebrush Lizard.

3.6 Accessibility, Local Resources, and

Infrastructure

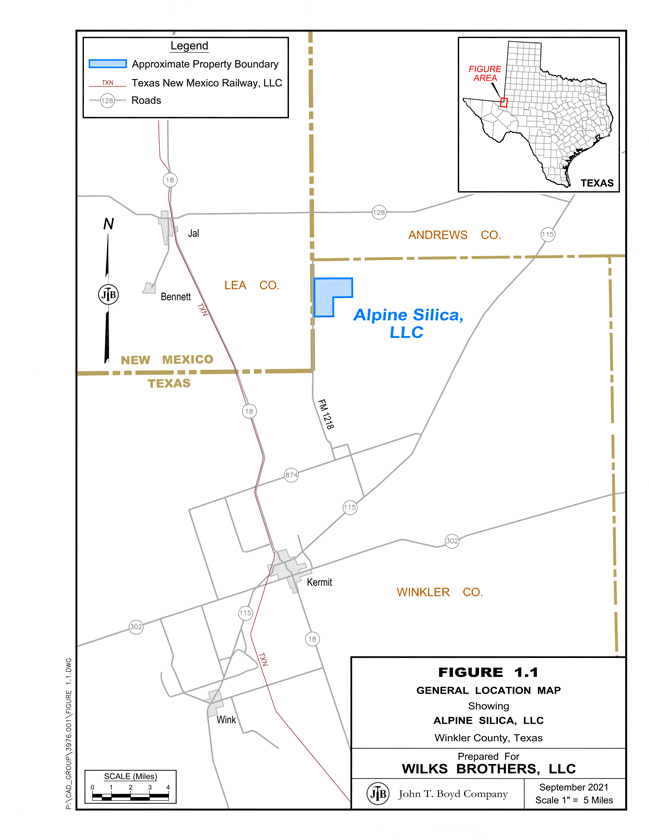

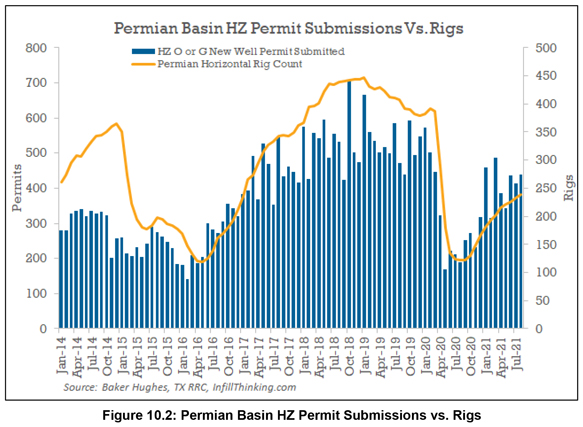

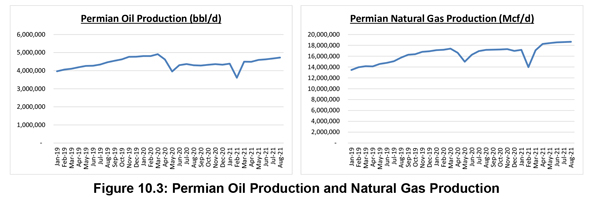

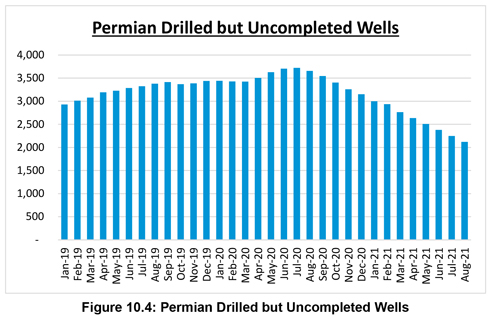

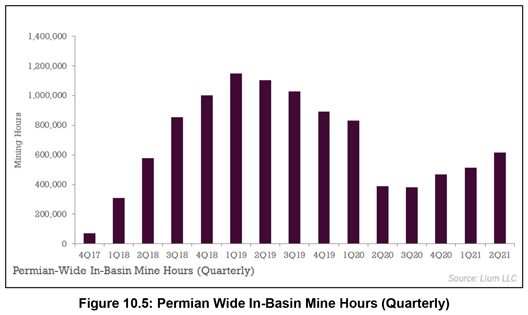

Alpine’s Kermit Mine is located near a handful of small rural towns in western Texas and southeastern New Mexico. The surrounding

region has a well-established history of oil and gas production, being located within the center of the Permian Basin. The surrounding counties have a combined population of over 200,000 people, according to 2020 population estimates by the Texas

Demographic Center.

General access to the Kermit Mine is via a well-developed network of primary and secondary roads serviced by state and local

governments. These roads offer direct access to the mine and processing facilities and are generally open year-round. Primary vehicular access to the property is via FM 1218, running north-south, following the Texas-New Mexico border. Various state

highways (302, 115, 18, 128) surround the subject property, and provide primary access to various portions of the oil and gas fields.

Several regional

airports are located between 10 to 35 miles of the Kermit Property.

Sources of three phase electrical power, natural gas, and other miscellaneous

materials are readily available. Water is currently supplied by a series of 12 wells installed around the periphery of the property, and by recycling wash process water from on-site ponds; a public water system permit application has been filed for

the subject property.

3.7 Physiography

The Kermit

Mine lies within the Texas Great Plains physiographic province, a region encompassing much of north-western and western Texas. The surrounding areas generally consist of desert valleys covered with windblown sheet and dune sands, high plains covered

with thick alluvium (the Llano Estacado or Staked Plains), or plateaus consisting of thin carbonate-based soils (the Caprock Escarpment). The plateau areas, typically covered by a weathering-resistant caliche (a hardened natural cement of calcium

carbonate that binds other materials—such as gravel, sand, clay, and silt), may abruptly stand up to 1,000 ft above the plains. Much of the region may be covered by various types of desert scrub grasses, sages, yuccas, junipers, shin oaks, and

mesquites.

JOHN T. BOYD COMPANY

3-4