| ProFrac Holdings Corp. (NASDAQ: ACDC) Investor Presentation - Earnings Recap www.PFHoldingsCorp.com March 2024 |

| Cautionary Statements 2 Forward-Looking Statements Certain statements in this press release may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be accompanied by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. Forward-looking statements relate to future events or the Company’s future financial or operating performance. These forward-looking statements include, among other things, statements regarding: the Company’s strategies and plans for growth; the Company’s positioning, resources, capabilities, and expectations for future performance; customer, market and industry demand and expectations; the Company’s expectations about price fluctuations, deferred activity from E&P companies, customer budgets and macroeconomic conditions impacting the industry; competitive conditions in the industry; the Company’s ongoing pursuit of dedicated agreements in 2024 with operators under contracted terms; the Company’s continued success in the RFP process; the Company’s ability to increase the utilization of its mining assets and lower our mining costs per ton; success of the Company’s ongoing strategic initiatives; the Company’s intention to increase the number of fully integrated fleets; the Company’s currently expected guidance regarding its 2024 financial and operational results; the Company’s ability to earn its targeted rates of return; pricing of the Company’s services in light of the prevailing market conditions; the Company’s currently expected guidance regarding its planned capital expenditures; statements regarding the Company’s liquidity and debt obligations; the Company’s anticipated timing for operationalizing and amount of contribution from its fleets and its sand mines; expectations regarding pricing per ton range; the amount of capital that may be available to the Company in future periods; any financial or other information based upon or otherwise incorporating judgments or estimates relating to future performance, events or expectations; any estimates and forecasts of financial and other performance metrics; and the Company’s outlook and financial and other guidance. Such forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the ability to achieve the anticipated benefits of the Company’s acquisitions, mining operations, and vertical integration strategy, including risks and costs relating to integrating acquired assets and personnel; risks that the Company’s actions intended to achieve its 2024 financial and operational guidance will be insufficient to achieve that guidance, either alone or in combination with external market, industry or other factors; the failure to operationalize or utilize to the extent anticipated the Company’s fleets and sand mines in a timely manner or at all; the Company's ability to deploy capital in a manner that furthers the Company's growth strategy, as well as the Company's general ability to execute its business plans; the risk that the Company may need more capital than it currently projects or that capital expenditures could increase beyond current expectations; industry conditions, including fluctuations in supply, demand and prices for the Company’s products and services; global and regional economic and financial conditions; the effectiveness of the Company’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Forward-looking statements are also subject to the risks and other issues described below under “Non-GAAP Financial Measures,” which could cause actual results to differ materially from current expectations included in the Company’s forward-looking statements included in this press release. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved, including without limitation any expectations about the Company’s operational and financial performance or achievements through and including 2024. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company anticipates that subsequent events and developments will cause its assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law. Non-GAAP Financial Measures Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures and should not be considered as a substitute for net income (loss) or net cash from operating activities, respectively, or any other performance measure derived in accordance with GAAP or as an alternative to net cash provided by operating activities as a measure of our profitability or liquidity. Adjusted EBITDA and Free Cash Flow are supplemental measures utilized by our management and other users of our financial statements such as investors, commercial banks, research analysts and others, to assess our financial performance. We believe Adjusted EBITDA is an important supplemental measure because it allows us to compare our operating performance on a consistent basis across periods by removing the effects of our capital structure (such as varying levels of interest expense), asset base (such as depreciation and amortization) and items outside the control of our management team (such as income tax rates). We believe Free Cash Flow is an important supplemental liquidity measure of the cash that is available (if any), after purchases of property and equipment, for operational expenses, investment in our business, and to make acquisitions, and Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash in excess of our capital investments in property and equipment. We view Adjusted EBITDA and Free Cash Flow as important indicators of performance. We define Adjusted EBITDA as our net income (loss), before (i) interest expense, net, (ii) income tax provision, (iii) depreciation, depletion and amortization, (iv) loss on disposal of assets, (v) stock-based compensation, and (vi) other charges, such as reorganization costs, stock compensation expense and other costs related to our initial public offering, certain credit losses, (gain) or loss on extinguishment of debt, unrealized loss (or gain) on investment, acquisition and integration expenses, litigation expenses and accruals for legal contingencies, and acquisition earn-out adjustments. We define Free Cash Flow as net cash provided by or (used in) operating activities less investment in property, plant and equipment plus proceeds from sale of assets. We believe that our presentation of Adjusted EBITDA and Free Cash Flow will provide useful information to investors in assessing our financial condition and results of operations. Net income (loss) is the GAAP measure most directly comparable to Adjusted EBITDA. Adjusted EBITDA should not be considered as an alternative to net income (loss). Adjusted EBITDA has important limitations as an analytical tool because it excludes some but not all items that affect the most directly comparable GAAP financial measure. Because Adjusted EBITDA may be defined differently by other companies in our industry, our definition of this non-GAAP financial measure may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Net cash provided by operating activities is the GAAP measure most directly comparable to Free Cash Flow. Free Cash Flow should not be considered as an alternative to net cash provided by operating activities. Free Cash Flow has important limitations as an analytical tool including that Free Cash Flow does not reflect the cash requirements necessary to service our indebtedness and Free Cash Flow is not a reliable measure for actual cash available to the Company at any one time. Because Free Cash Flow may be defined differently by other companies in our industry, our definition of this Non-GAAP Financial Measure may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. The presentation of Non-GAAP Financial Measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. The following tables present a reconciliation of the Non-GAAP Financial Measures of Adjusted EBITDA and Free Cash Flow to the most directly comparable GAAP financial measure for the periods indicated. |

| Decisive Leadership Delivering Results 3 Matt Wilks Executive Chairman A message from our Chairman: “We have been deliberate and intentional with the actions we’ve taken, both in the second half of 2023 and early in 2024, to enhance ProFrac’s position as a leader in the oilfield services industry. Beginning in 2023, we believed it was important to simplify our approach and focus on three key strategic priorities: providing safe, superior services and improving the overall experience for our customers; improving utilization in every aspect of our business; and achieving the lowest operating costs per unit in the industry. “I am pleased that we have started seeing the impact of this targeted focus in 2024 as we have increased our fleet count for the start of the year with improved pumping efficiencies across all active fleets. To start the year, in January we surpassed our highest pumping efficiency since the fourth quarter of 2022 and in February we pushed the bar even higher as we increased our pumping hours per active fleet to the highest level ever recorded at ProFrac, nearly 20% over our 2023 average. This positive momentum gives us strong confidence that 2024 will be significantly improved over 2023.” |

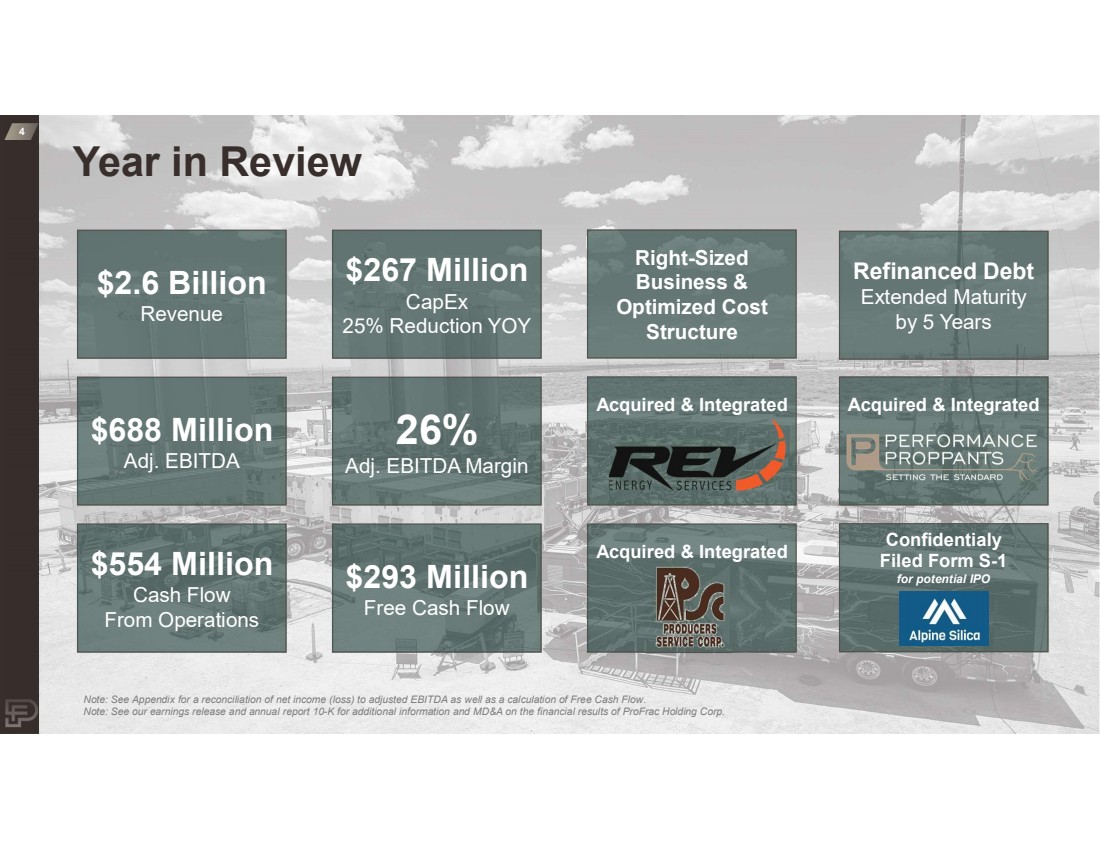

| 4 Year in Review $2.6 Billion Revenue $688 Million Adj. EBITDA $554 Million Cash Flow From Operations $267 Million CapEx 25% Reduction YOY 26% Adj. EBITDA Margin $293 Million Free Cash Flow Acquired & Integrated Right-Sized Business & Optimized Cost Structure Refinanced Debt Extended Maturity by 5 Years Acquired & Integrated Acquired & Integrated Confidentialy Filed Form S-1 for potential IPO Note: See Appendix for a reconciliation of net income (loss) to adjusted EBITDA as well as a calculation of Free Cash Flow. Note: See our earnings release and annual report 10-K for additional information and MD&A on the financial results of ProFrac Holding Corp. |

| With Our Acquisitions/Integrations Behind Us, We Are Refocused On Our Core: Pumping Stages & Selling Sand 5 We expect to outperform in 2024 and regain market share regardless of whether activity rises, falls, or remains at constant levels ‒ Our leadership teams have instilled a laser like focus on our strategic initiatives so that all segments are aligned in our shared goals ‒ This has already led to quicker decision making, more direct allocation of capital, and improved customer service across our business lines and we continue to improve on those fronts Improving the Customer Experience Prioritize long term partnerships Provide custom tailored solutions Prioritize value over price Constant operational improvement Maximizing Utilization & Efficiencies Redeploy stacked fleets to earn attractive returns Target the right customers and eliminate white space Invest in mines to relieve bottlenecks and enhance throughput Keeping a Firm Grip on Cost Control Utilize overbuilt inventory on-hand and exploit benefits of scale Better coordination across maintenance and refurb facilities Measure all aspects of spend and improve accountability |

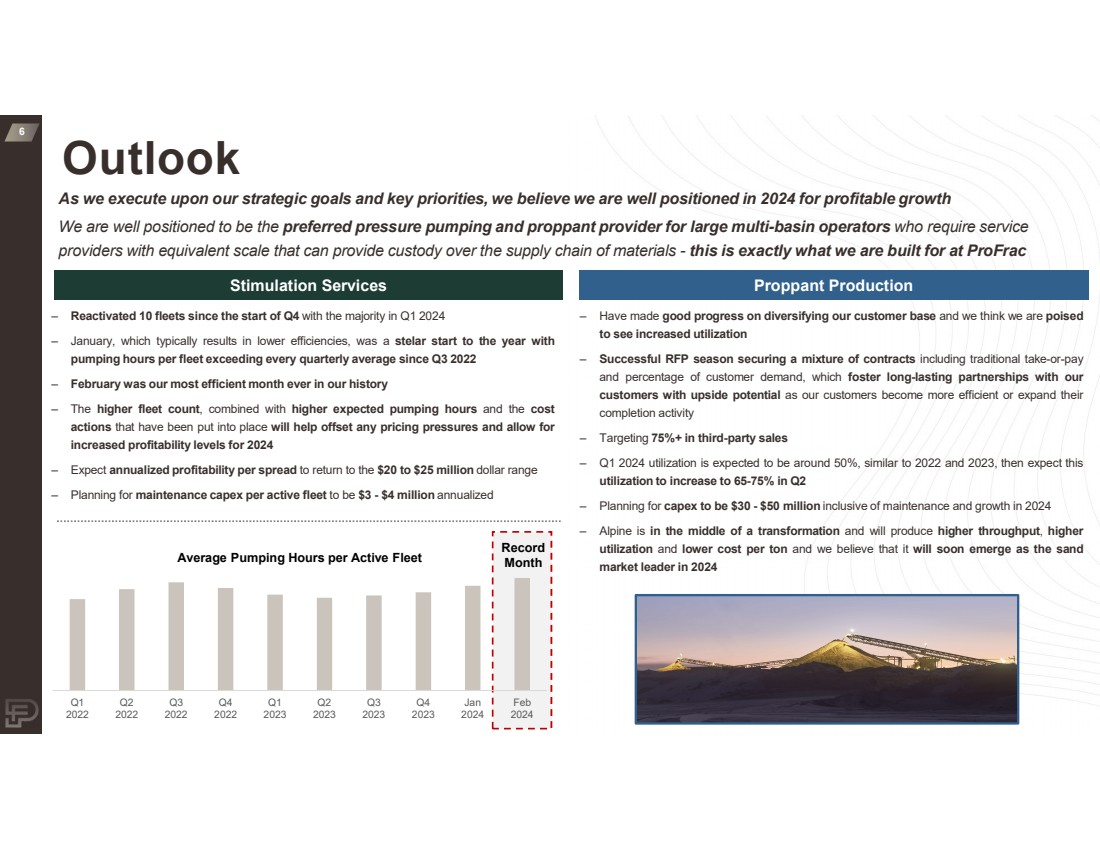

| Outlook 6 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Jan 2024 Feb 2024 Record Month Stimulation Services Proppant Production Average Pumping Hours per Active Fleet ‒ Reactivated 10 fleets since the start of Q4 with the majority in Q1 2024 ‒ January, which typically results in lower efficiencies, was a stelar start to the year with pumping hours per fleet exceeding every quarterly average since Q3 2022 ‒ February was our most efficient month ever in our history ‒ The higher fleet count, combined with higher expected pumping hours and the cost actions that have been put into place will help offset any pricing pressures and allow for increased profitability levels for 2024 ‒ Expect annualized profitability per spread to return to the $20 to $25 million dollar range ‒ Planning for maintenance capex per active fleet to be $3 - $4 million annualized As we execute upon our strategic goals and key priorities, we believe we are well positioned in 2024 for profitable growth We are well positioned to be the preferred pressure pumping and proppant provider for large multi-basin operators who require service providers with equivalent scale that can provide custody over the supply chain of materials - this is exactly what we are built for at ProFrac ‒ Have made good progress on diversifying our customer base and we think we are poised to see increased utilization ‒ Successful RFP season securing a mixture of contracts including traditional take-or-pay and percentage of customer demand, which foster long-lasting partnerships with our customers with upside potential as our customers become more efficient or expand their completion activity ‒ Targeting 75%+ in third-party sales ‒ Q1 2024 utilization is expected to be around 50%, similar to 2022 and 2023, then expect this utilization to increase to 65-75% in Q2 ‒ Planning for capex to be $30 - $50 million inclusive of maintenance and growth in 2024 ‒ Alpine is in the middle of a transformation and will produce higher throughput, higher utilization and lower cost per ton and we believe that it will soon emerge as the sand market leader in 2024 |

| 7 The Premier Vertically-Integrated Energy Services Holding Company Our Portfolio Companies: Other Investments Leading portfolio of next-generation (Tier IV DGB and Electric) frac fleets Operations in major unconventional oil and natural gas plays in the U.S. Permian: 3 mines with 8.5 mmtpy nameplate capacity Eagle Ford: 1 mine with 3.0 mmtpy nameplate capacity Haynesville: 4 mines with 10.0 mmtpy nameplate capacity Internal frac fleet manufacturing capabilities Fluid ends Power ends High pressure iron Engine rebuilds Manufacturing common replacement parts Electrification automation and technology Control systems Pressure control equipment and services Specialty chemicals Emissions monitoring PF Holdings’ portfolio of innovation-driven companies offer complementary products and services, forming a vertically-integrated energy services company catering to leading upstream oil and gas producers ~75% Third-Party Sales |

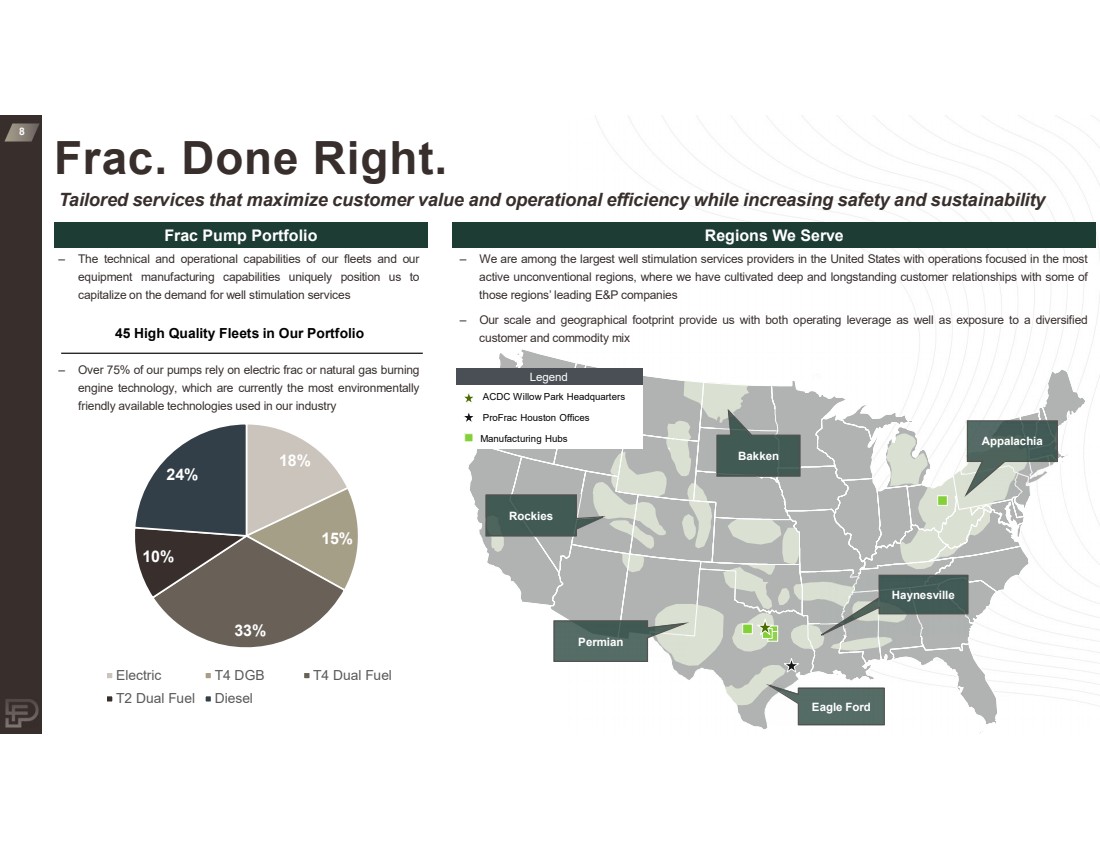

| 8 (1) Rockies Bakken Appalachia Haynesville Eagle Ford Permian Frac Pump Portfolio Regions We Serve ‒ We are among the largest well stimulation services providers in the United States with operations focused in the most active unconventional regions, where we have cultivated deep and longstanding customer relationships with some of those regions’ leading E&P companies ‒ Our scale and geographical footprint provide us with both operating leverage as well as exposure to a diversified customer and commodity mix ‒ The technical and operational capabilities of our fleets and our equipment manufacturing capabilities uniquely position us to capitalize on the demand for well stimulation services ‒ Over 75% of our pumps rely on electric frac or natural gas burning engine technology, which are currently the most environmentally friendly available technologies used in our industry 45 High Quality Fleets in Our Portfolio 18% 15% 33% 10% 24% Electric T4 DGB T4 Dual Fuel T2 Dual Fuel Diesel Legend ACDC Willow Park Headquarters ProFrac Houston Offices Manufacturing Hubs Frac. Done Right. Tailored services that maximize customer value and operational efficiency while increasing safety and sustainability |

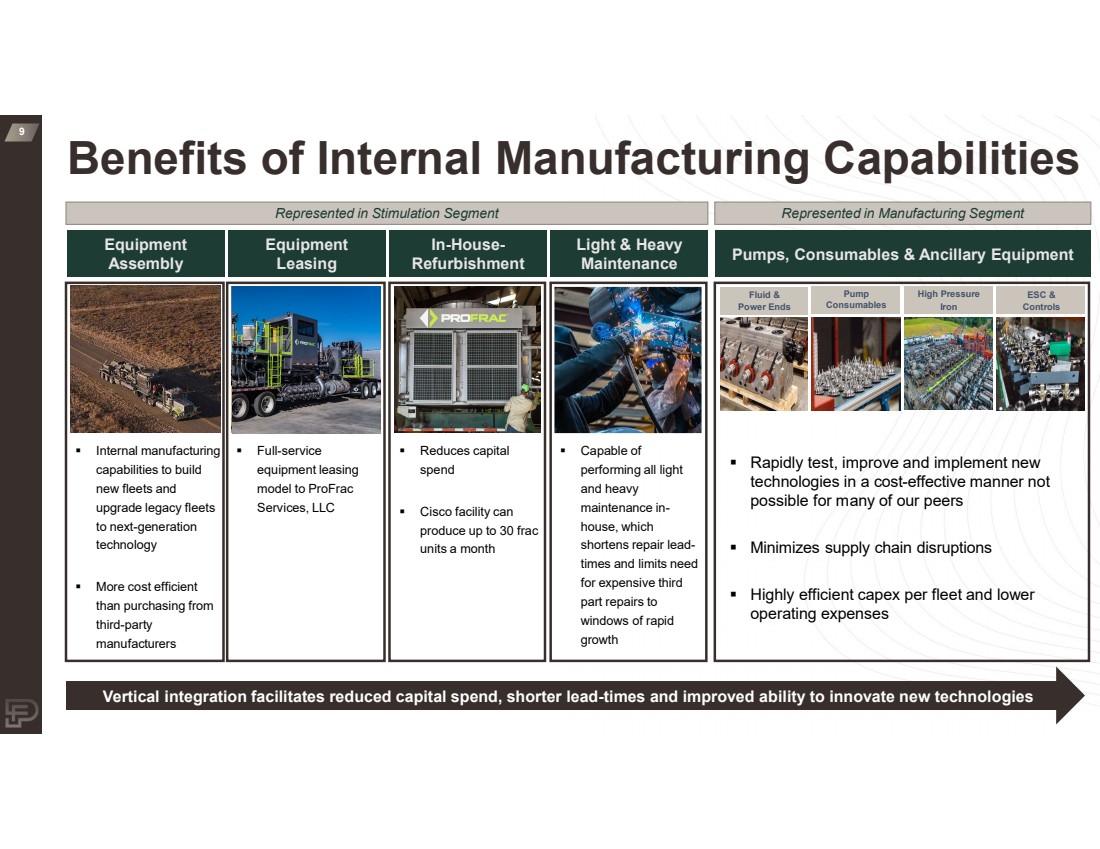

| 9 Benefits of Internal Manufacturing Capabilities Equipment Assembly Internal manufacturing capabilities to build new fleets and upgrade legacy fleets to next-generation technology More cost efficient than purchasing from third-party manufacturers Equipment Leasing Reduces capital spend Cisco facility can produce up to 30 frac units a month Pumps, Consumables & Ancillary Equipment Rapidly test, improve and implement new technologies in a cost-effective manner not possible for many of our peers Minimizes supply chain disruptions Highly efficient capex per fleet and lower operating expenses Fluid & Power Ends Pump Consumables High Pressure Iron ESC & Controls Vertical integration facilitates reduced capital spend, shorter lead-times and improved ability to innovate new technologies Represented in Stimulation Segment Represented in Manufacturing Segment In-House-Refurbishment Capable of performing all light and heavy maintenance in-house, which shortens repair lead-times and limits need for expensive third part repairs to windows of rapid growth Light & Heavy Maintenance Full-service equipment leasing model to ProFrac Services, LLC |

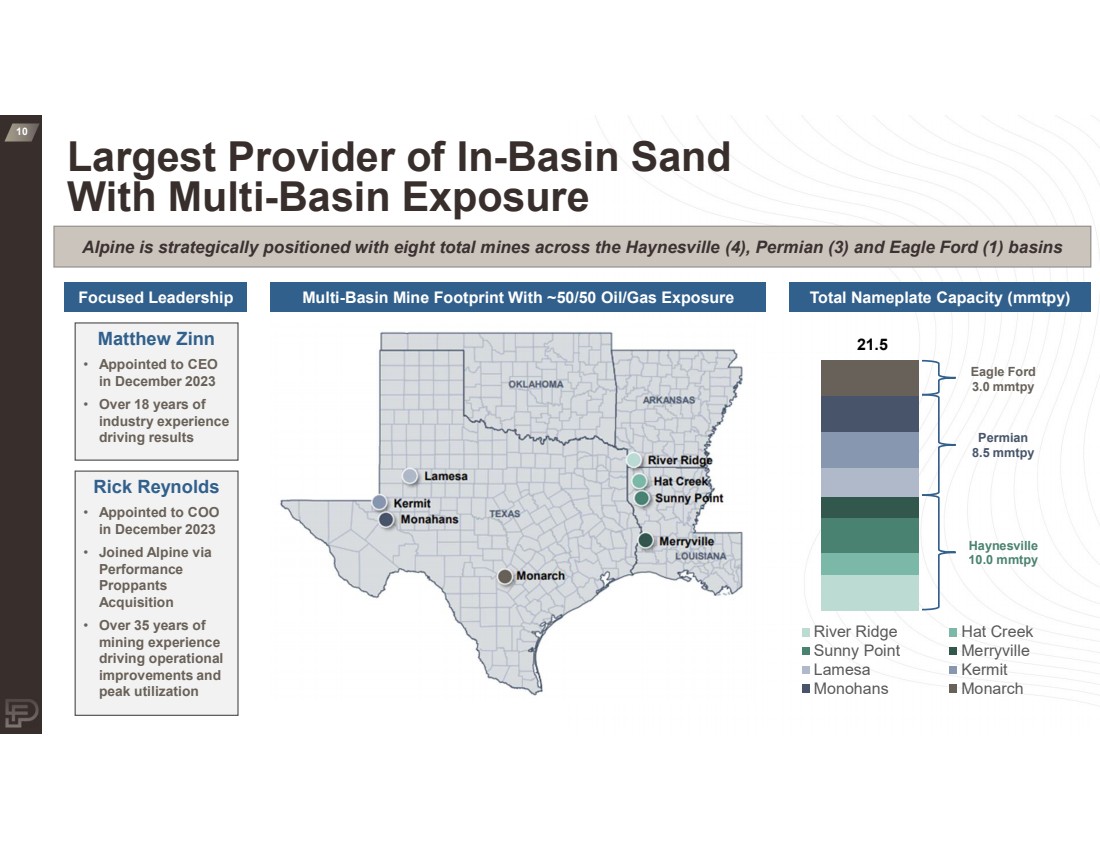

| 10 Alpine is strategically positioned with eight total mines across the Haynesville (4), Permian (3) and Eagle Ford (1) basins Total Nameplate Capacity (mmtpy) River Ridge Hat Creek Sunny Point Merryville Lamesa Kermit Monohans Monarch 21.5 Eagle Ford 3.0 mmtpy Permian 8.5 mmtpy Haynesville 10.0 mmtpy Focused Leadership Multi-Basin Mine Footprint With ~50/50 Oil/Gas Exposure Matthew Zinn • Appointed to CEO in December 2023 • Over 18 years of industry experience driving results Rick Reynolds • Appointed to COO in December 2023 • Joined Alpine via Performance Proppants Acquisition • Over 35 years of mining experience driving operational improvements and peak utilization Largest Provider of In-Basin Sand With Multi-Basin Exposure |

| Appendix: Financial Tables |

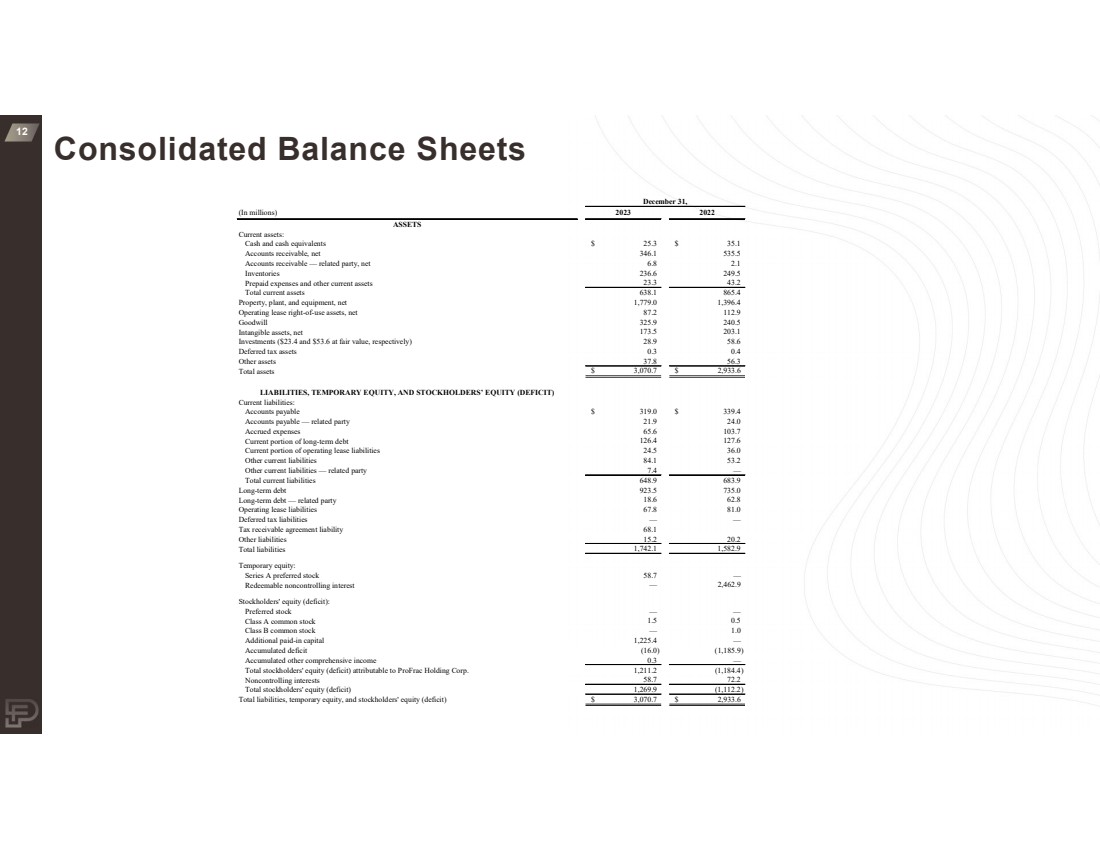

| 12 (In millions) 2023 2022 ASSETS Current assets: Cash and cash equivalents $ 35.1 25.3 $ Accounts receivable, net 535.5 346.1 Accounts receivable — related party, net 2.1 6.8 Inventories 249.5 236.6 Prepaid expenses and other current assets 43.2 23.3 Total current assets 865.4 638.1 Property, plant, and equipment, net 1,396.4 1,779.0 Operating lease right-of-use assets, net 112.9 87.2 Goodwill 240.5 325.9 Intangible assets, net 203.1 173.5 Investments ($23.4 and $53.6 at fair value, respectively) 58.6 28.9 Deferred tax assets 0.4 0.3 Other assets 56.3 37.8 Total assets $ 3,070.7 $ 2,933.6 LIABILITIES, TEMPORARY EQUITY, AND STOCKHOLDERS’ EQUITY (DEFICIT) Current liabilities: Accounts payable $ 339.4 319.0 $ Accounts payable — related party 24.0 21.9 Accrued expenses 103.7 65.6 Current portion of long-term debt 127.6 126.4 Current portion of operating lease liabilities 36.0 24.5 Other current liabilities 53.2 84.1 Other current liabilities — related party — 7.4 Total current liabilities 683.9 648.9 Long-term debt 735.0 923.5 Long-term debt — related party 62.8 18.6 Operating lease liabilities 81.0 67.8 Deferred tax liabilities — — Tax receivable agreement liability 68.1 Other liabilities 20.2 15.2 Total liabilities 1,582.9 1,742.1 Temporary equity: Series A preferred stock — 58.7 Redeemable noncontrolling interest 2,462.9 — Stockholders' equity (deficit): Preferred stock — — Class A common stock 0.5 1.5 Class B common stock 1.0 — Additional paid-in capital — 1,225.4 Accumulated deficit (1,185.9) (16.0) Accumulated other comprehensive income — 0.3 Total stockholders' equity (deficit) attributable to ProFrac Holding Corp. (1,184.4) 1,211.2 Noncontrolling interests 72.2 58.7 Total stockholders' equity (deficit) (1,112.2) 1,269.9 Total liabilities, temporary equity, and stockholders' equity (deficit) $ 3,070.7 $ 2,933.6 December 31, Consolidated Balance Sheets |

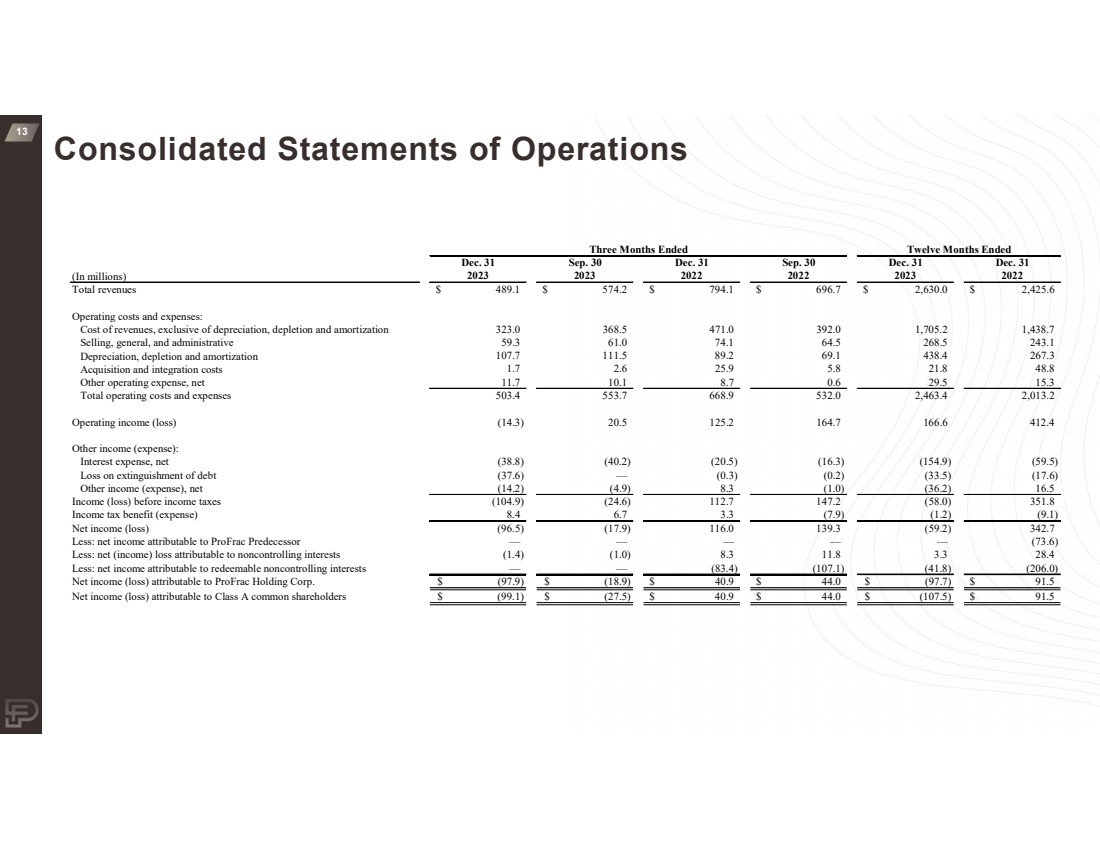

| 13 Consolidated Statements of Operations Dec. 31 Sep. 30 Dec. 31 Sep. 30 Dec. 31 Dec. 31 (In millions) 2023 2023 2022 2022 2023 2022 Total revenues $ 574.2 489.1 $ 794.1 $ 696.7 $ 2,630.0 $ 2,425.6 $ Operating costs and expenses: Cost of revenues, exclusive of depreciation, depletion and amortization 323.0 368.5 471.0 392.0 1,705.2 1,438.7 Selling, general, and administrative 61.0 59.3 74.1 64.5 268.5 243.1 Depreciation, depletion and amortization 111.5 107.7 89.2 69.1 438.4 267.3 Acquisition and integration costs 1.7 2.6 25.9 5.8 21.8 48.8 Other operating expense, net 11.7 10.1 8.7 0.6 29.5 15.3 Total operating costs and expenses 553.7 503.4 668.9 532.0 2,463.4 2,013.2 Operating income (loss) (14.3) 20.5 125.2 164.7 166.6 412.4 Other income (expense): Interest expense, net (38.8) (40.2) (20.5) (16.3) (154.9) (59.5) Loss on extinguishment of debt (37.6) — (0.3) (0.2) (33.5) (17.6) Other income (expense), net (14.2) (4.9) 8.3 (1.0) (36.2) 16.5 Income (loss) before income taxes (104.9) (24.6) 112.7 147.2 (58.0) 351.8 Income tax benefit (expense) 8.4 6.7 3.3 (7.9) (1.2) (9.1) Net income (loss) (96.5) (17.9) 116.0 139.3 (59.2) 342.7 Less: net income attributable to ProFrac Predecessor — — — — — (73.6) Less: net (income) loss attributable to noncontrolling interests (1.4) (1.0) 8.3 11.8 3.3 28.4 Less: net income attributable to redeemable noncontrolling interests — — (83.4) (107.1) (41.8) (206.0) Net income (loss) attributable to ProFrac Holding Corp. $ (97.9) $ (18.9) $ 40.9 $ 44.0 $ (97.7) $ 91.5 Net income (loss) attributable to Class A common shareholders (99.1) $ (27.5) $ 40.9 $ 44.0 $ (107.5) $ 91.5 $ Three Months Ended Twelve Months Ended |

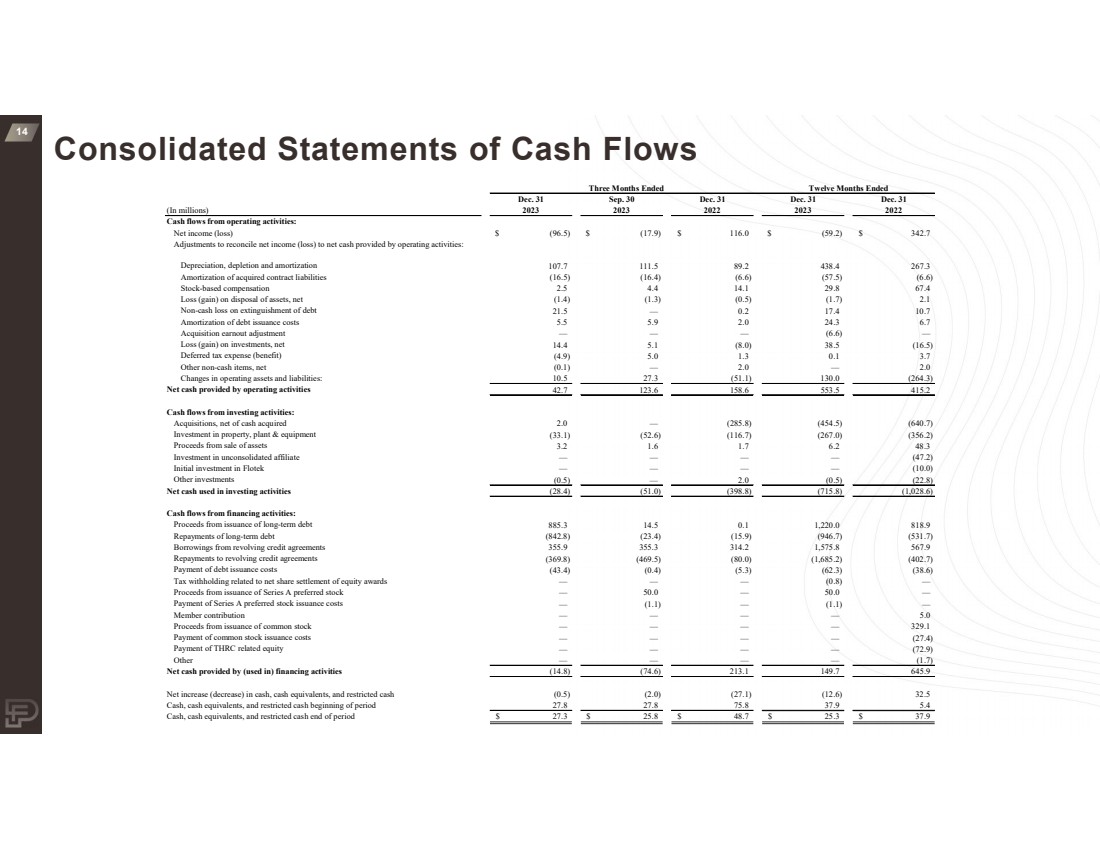

| 14 Consolidated Statements of Cash Flows Dec. 31 Sep. 30 Dec. 31 Dec. 31 Dec. 31 (In millions) 2023 2023 2022 2023 2022 Cash flows from operating activities: Net income (loss) $ (17.9) (96.5) $ 116.0 $ (59.2) $ 342.7 $ Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation, depletion and amortization 111.5 107.7 89.2 438.4 267.3 Amortization of acquired contract liabilities (16.4) (16.5) (6.6) (57.5) (6.6) Stock-based compensation 4.4 2.5 14.1 29.8 67.4 Loss (gain) on disposal of assets, net (1.3) (1.4) (0.5) (1.7) 2.1 Non-cash loss on extinguishment of debt — 21.5 0.2 17.4 10.7 Amortization of debt issuance costs 5.9 5.5 2.0 24.3 6.7 Acquisition earnout adjustment — — — (6.6) — Loss (gain) on investments, net 5.1 14.4 (8.0) 38.5 (16.5) Deferred tax expense (benefit) 5.0 (4.9) 1.3 0.1 3.7 Other non-cash items, net — (0.1) 2.0 — 2.0 Changes in operating assets and liabilities: 27.3 10.5 (51.1) 130.0 (264.3) Net cash provided by operating activities 123.6 42.7 158.6 553.5 415.2 Cash flows from investing activities: Acquisitions, net of cash acquired — 2.0 (285.8) (454.5) (640.7) Investment in property, plant & equipment (52.6) (33.1) (116.7) (267.0) (356.2) Proceeds from sale of assets 1.6 3.2 1.7 6.2 48.3 Investment in unconsolidated affiliate — — — — (47.2) Initial investment in Flotek — — — — (10.0) Other investments — (0.5) 2.0 (0.5) (22.8) Net cash used in investing activities (51.0) (28.4) (398.8) (715.8) (1,028.6) Cash flows from financing activities: Proceeds from issuance of long-term debt 14.5 885.3 0.1 1,220.0 818.9 Repayments of long-term debt (23.4) (842.8) (15.9) (946.7) (531.7) Borrowings from revolving credit agreements 355.3 355.9 314.2 1,575.8 567.9 Repayments to revolving credit agreements (469.5) (369.8) (80.0) (1,685.2) (402.7) Payment of debt issuance costs (0.4) (43.4) (5.3) (62.3) (38.6) Tax withholding related to net share settlement of equity awards — — — (0.8) — Proceeds from issuance of Series A preferred stock 50.0 — — 50.0 — Payment of Series A preferred stock issuance costs (1.1) — — (1.1) — Member contribution — — — — 5.0 Proceeds from issuance of common stock — — — — 329.1 Payment of common stock issuance costs — — — — (27.4) Payment of THRC related equity — — — — (72.9) Other — — — — (1.7) Net cash provided by (used in) financing activities (74.6) (14.8) 213.1 149.7 645.9 Net increase (decrease) in cash, cash equivalents, and restricted cash (2.0) (0.5) (27.1) (12.6) 32.5 Cash, cash equivalents, and restricted cash beginning of period 27.8 27.8 75.8 37.9 5.4 Cash, cash equivalents, and restricted cash end of period $ 25.8 27.3 $ 48.7 $ 25.3 $ 37.9 $ Three Months Ended Twelve Months Ended |

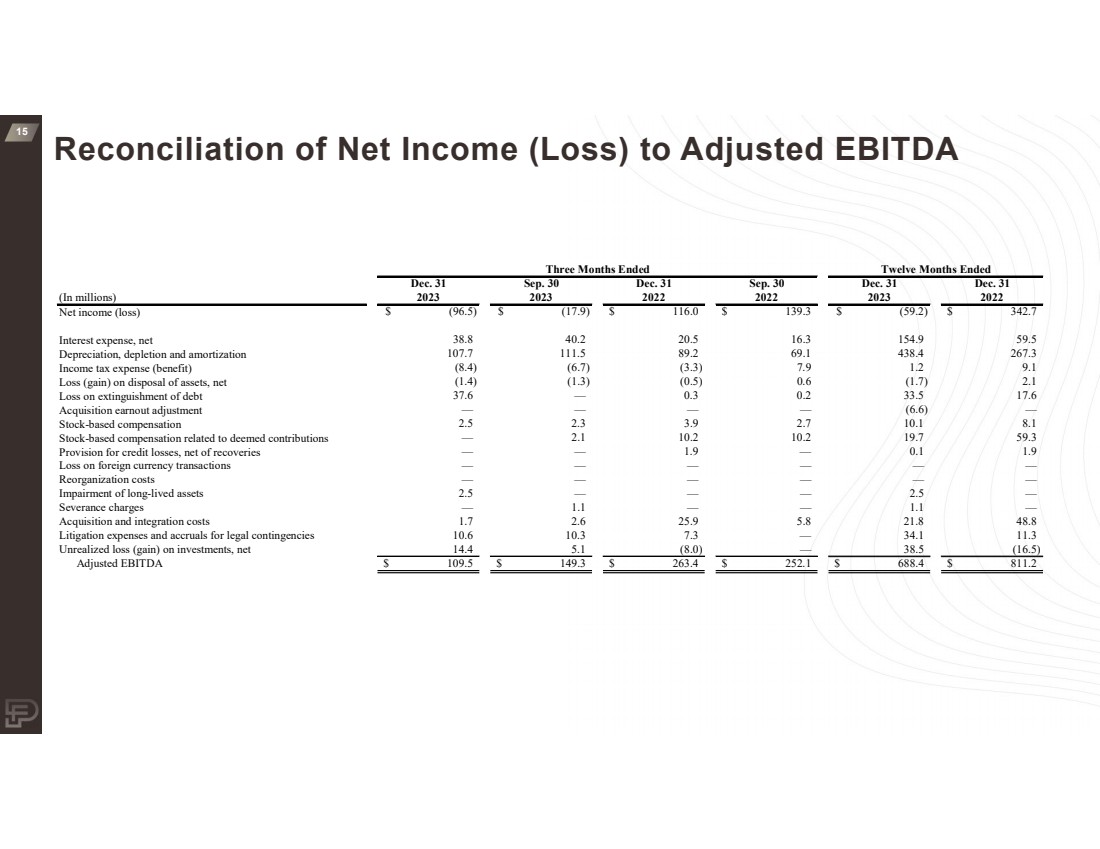

| 15 Reconciliation of Net Income (Loss) to Adjusted EBITDA Dec. 31 Sep. 30 Dec. 31 Sep. 30 Dec. 31 Dec. 31 (In millions) 2023 2023 2022 2022 2023 2022 Net income (loss) $ (17.9) (96.5) $ 116.0 $ 139.3 $ (59.2) $ 342.7 $ Interest expense, net 40.2 38.8 20.5 16.3 154.9 59.5 Depreciation, depletion and amortization 111.5 107.7 89.2 69.1 438.4 267.3 Income tax expense (benefit) (6.7) (8.4) (3.3) 7.9 1.2 9.1 Loss (gain) on disposal of assets, net (1.3) (1.4) (0.5) 0.6 (1.7) 2.1 Loss on extinguishment of debt — 37.6 0.3 0.2 33.5 17.6 Acquisition earnout adjustment — — — — (6.6) — Stock-based compensation 2.3 2.5 3.9 2.7 10.1 8.1 Stock-based compensation related to deemed contributions 2.1 — 10.2 10.2 19.7 59.3 Provision for credit losses, net of recoveries — — 1.9 — 0.1 1.9 Loss on foreign currency transactions — — — — — — Reorganization costs — — — — — — Impairment of long-lived assets 2.5 — — — 2.5 — Severance charges — 1.1 — — 1.1 — Acquisition and integration costs 1.7 2.6 25.9 5.8 21.8 48.8 Litigation expenses and accruals for legal contingencies 10.6 10.3 7.3 — 34.1 11.3 Unrealized loss (gain) on investments, net 14.4 5.1 (8.0) — 38.5 (16.5) Adjusted EBITDA $ 109.5 $ 149.3 $ 263.4 $ 252.1 $ 688.4 $ 811.2 Three Months Ended Twelve Months Ended |

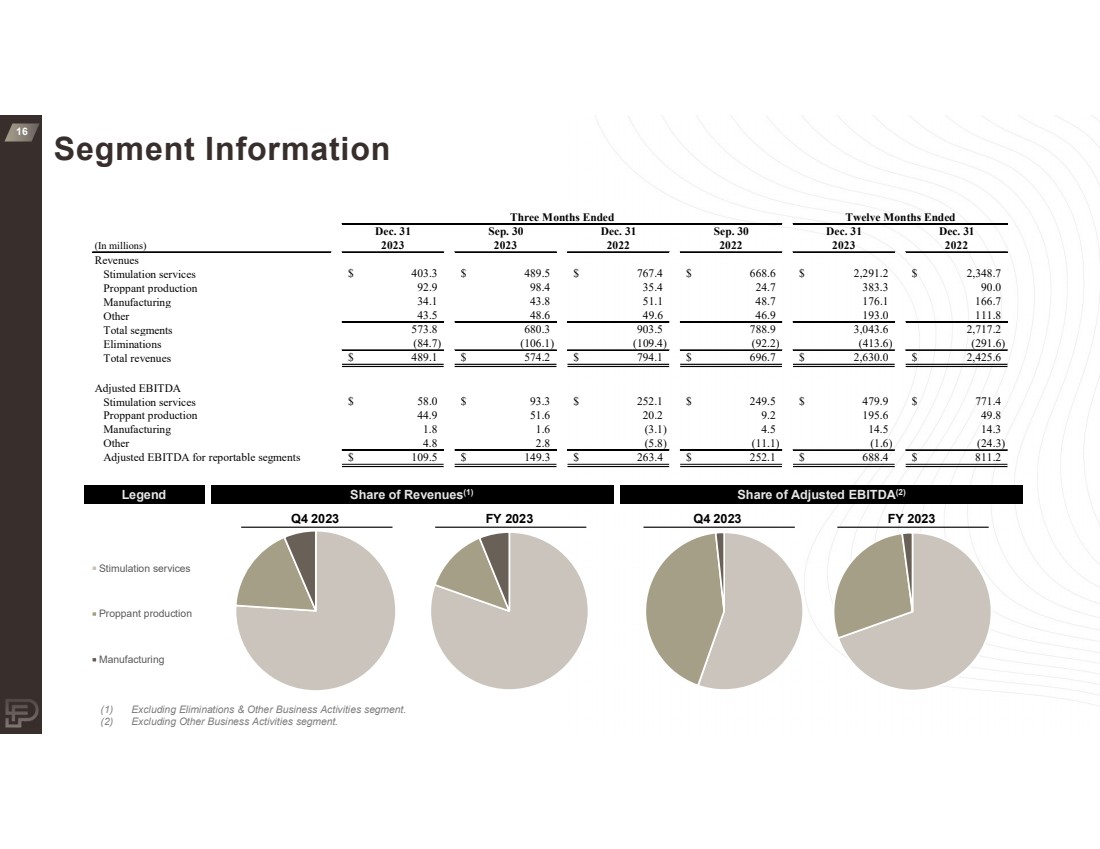

| 16 Segment Information Dec. 31 Sep. 30 Dec. 31 Sep. 30 Dec. 31 Dec. 31 (In millions) 2023 2023 2022 2022 2023 2022 Revenues Stimulation services $ 489.5 403.3 $ 767.4 $ 668.6 $ 2,291.2 $ 2,348.7 $ Proppant production 98.4 92.9 35.4 24.7 383.3 90.0 Manufacturing 34.1 43.8 51.1 48.7 176.1 166.7 Other 43.5 48.6 49.6 46.9 193.0 111.8 Total segments 680.3 573.8 903.5 788.9 3,043.6 2,717.2 Eliminations (106.1) (84.7) (109.4) (92.2) (413.6) (291.6) Total revenues $ 574.2 489.1 $ 794.1 $ 696.7 $ 2,630.0 $ 2,425.6 $ Adjusted EBITDA Stimulation services $ 93.3 58.0 $ 252.1 $ 249.5 $ 479.9 $ 771.4 $ Proppant production 44.9 51.6 20.2 9.2 195.6 49.8 Manufacturing 1.8 1.6 (3.1) 4.5 14.5 14.3 Other 4.8 2.8 (5.8) (11.1) (1.6) (24.3) Adjusted EBITDA for reportable segments $ 109.5 $ 149.3 $ 263.4 $ 252.1 $ 688.4 $ 811.2 Three Months Ended Twelve Months Ended Stimulation services Proppant production Manufacturing Share of Revenues(1) Q4 2023 FY 2023 Share of Adjusted EBITDA(2) Q4 2023 FY 2023 Legend (1) Excluding Eliminations & Other Business Activities segment. (2) Excluding Other Business Activities segment. |

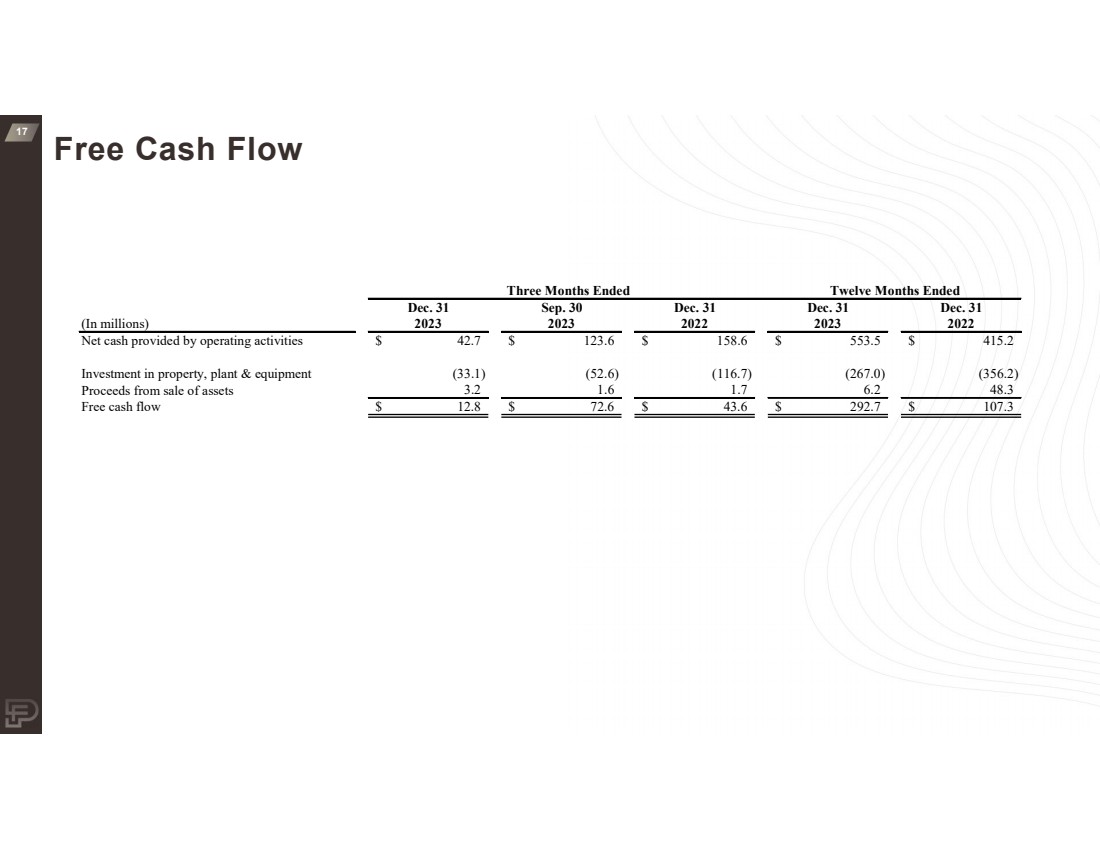

| 17 Free Cash Flow Dec. 31 Sep. 30 Dec. 31 Dec. 31 Dec. 31 (In millions) 2023 2023 2022 2023 2022 Net cash provided by operating activities $ 123.6 42.7 $ 158.6 $ 553.5 $ 415.2 $ Investment in property, plant & equipment (33.1) (52.6) (116.7) (267.0) (356.2) Proceeds from sale of assets 1.6 3.2 1.7 6.2 48.3 Free cash flow $ 12.8 $ 72.6 $ 43.6 $ 292.7 $ 107.3 Three Months Ended Twelve Months Ended |

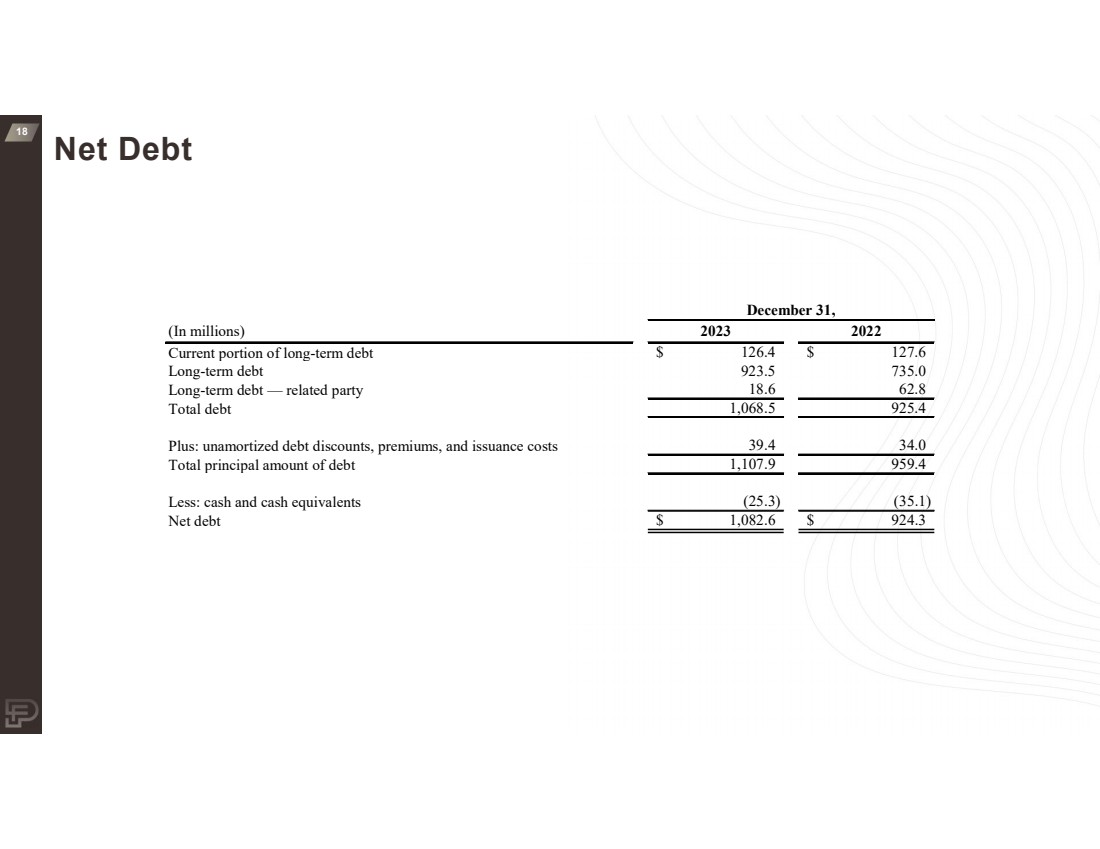

| 18 Net Debt (In millions) 2023 2022 Current portion of long-term debt $ 127.6 126.4 $ Long-term debt 735.0 923.5 Long-term debt — related party 62.8 18.6 Total debt 925.4 1,068.5 Plus: unamortized debt discounts, premiums, and issuance costs 34.0 39.4 Total principal amount of debt 959.4 1,107.9 Less: cash and cash equivalents (35.1) (25.3) Net debt $ 1,082.6 $ 924.3 December 31, |

| Investor Relations Contacts ProFrac Holding Corp. Lance Turner – Chief Financial Officer Michael Messina – Director of Finance investors@profrac.com Dennard Lascar Investor Relations Ken Dennard / Rick Black ACDC@dennardlascar.com |